What is Economic Value Added (EVA)? A Beginner’s Guide to True Profitability

In the world of business and finance, understanding a company’s true performance goes far beyond just looking at its reported profit. While a company might show a healthy net income on paper, it could still be destroying value for its shareholders if it’s not generating enough return to cover the cost of the capital it uses. This is where Economic Value Added (EVA) comes in.

EVA is a powerful financial metric designed to measure a company’s true economic profit. It helps businesses, investors, and analysts understand whether a company is truly creating wealth for its owners after accounting for all the costs of doing business, including the cost of the capital invested.

If you’ve ever wondered how companies can be "profitable" but still be considered poor investments, EVA holds a crucial part of the answer. Let’s dive deep into what EVA is, how it’s calculated, why it matters, and how it differs from traditional profit measures.

Beyond Simple Profit: The Core Concept of EVA

Imagine you own a house and rent it out. You collect rent, but you also have mortgage payments, property taxes, and maintenance costs. If your rent income only just covers these expenses, you’re not really making a "profit" in the sense of building wealth. You’re just breaking even after all your costs.

Similarly, every business uses capital – money from investors (shareholders) and lenders (banks). This capital isn’t free; it has a cost. Shareholders expect a return on their investment, and lenders charge interest. Traditional accounting profit (like net income) only subtracts explicit costs like operating expenses and interest payments. It often doesn’t explicitly subtract the cost of using the shareholders’ money (equity capital).

Economic Value Added (EVA) fills this gap. It measures the profit a company makes after deducting the cost of capital it employs. In essence, EVA asks: "Did the company generate enough profit to cover all its operating expenses and provide an adequate return to its investors for the risk they took?"

- If EVA is Positive: The company is creating wealth for its shareholders. It’s generating more profit than the cost of the capital it uses.

- If EVA is Negative: The company is destroying wealth. It’s not generating enough profit to cover the cost of its capital, even if it’s showing a positive net income.

The EVA Formula: Breaking Down the Components

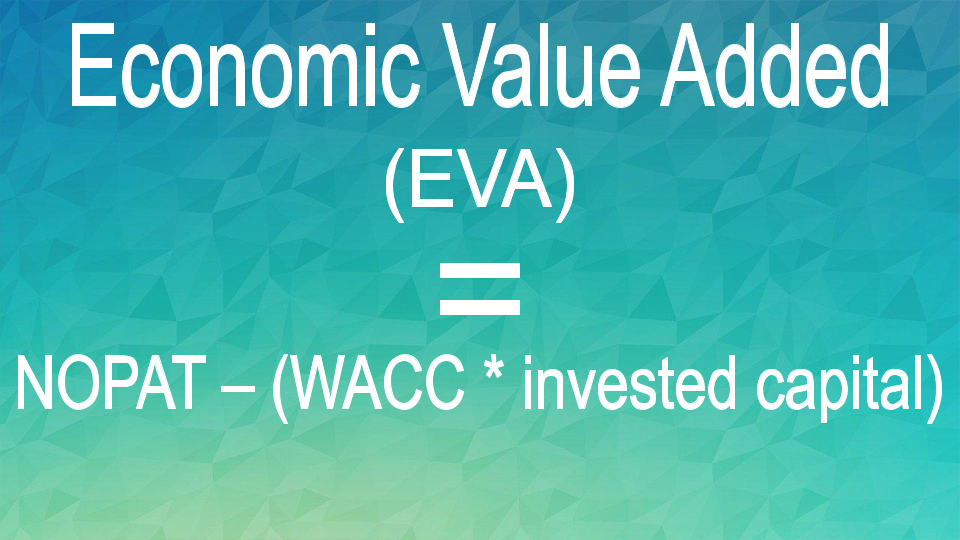

The formula for calculating Economic Value Added is straightforward once you understand its individual components:

EVA = NOPAT – (Invested Capital × WACC)

Let’s break down each part:

1. NOPAT (Net Operating Profit After Tax)

NOPAT stands for Net Operating Profit After Tax. This is the profit a company generates from its core operations after paying taxes, but before accounting for any interest expenses.

- Why NOPAT? We use NOPAT because it represents the profit generated by the company’s core business activities, independent of how those activities are financed (whether through debt or equity). Interest expenses are a financing cost, which will be accounted for separately in the WACC.

- Calculation: NOPAT is typically calculated as:

Operating Income (EBIT) × (1 - Tax Rate)

Where EBIT is Earnings Before Interest and Taxes.

2. Invested Capital

Invested Capital (also known as Capital Employed) represents the total amount of money that a company has tied up in its operations. This includes both the money provided by shareholders (equity) and money borrowed from lenders (debt). It’s essentially the financial resources a company uses to generate its NOPAT.

- What it includes: This typically covers assets like property, plant, and equipment (PP&E), inventory, and accounts receivable, minus non-interest-bearing liabilities like accounts payable.

- Importance: It tells you how much "money" is actively working within the business.

3. WACC (Weighted Average Cost of Capital)

WACC stands for Weighted Average Cost of Capital. This is one of the most critical components of EVA. It represents the average rate of return a company must pay to all its lenders and shareholders for the use of their capital. Think of it as the "hurdle rate" or the minimum return a company must earn on its existing asset base to satisfy its investors.

- Why Weighted Average? Companies typically use a mix of debt and equity to finance their operations. WACC calculates the average cost of this blend, weighted by the proportion of each source of financing.

- Components:

- Cost of Debt: The interest rate a company pays on its borrowings, adjusted for the tax deductibility of interest.

- Cost of Equity: The return shareholders expect to earn for investing in the company, reflecting the risk they are taking.

- Importance: If a company doesn’t earn a return at least equal to its WACC, it’s not generating enough value to cover its cost of funding, meaning it’s destroying shareholder wealth.

The "Capital Charge"

The second part of the EVA formula – (Invested Capital × WACC) – is often referred to as the Capital Charge. It represents the minimum return that the company must generate to satisfy its capital providers. It’s the "rent" the company pays for using its capital.

A Simple EVA Example

Let’s imagine "FutureTech Innovations Inc."

- NOPAT: $1,000,000

- Invested Capital: $5,000,000

- WACC: 15%

Now, let’s calculate FutureTech’s EVA:

-

Calculate the Capital Charge:

Capital Charge = Invested Capital × WACC

Capital Charge = $5,000,000 × 0.15 = $750,000 -

Calculate EVA:

EVA = NOPAT – Capital Charge

EVA = $1,000,000 – $750,000 = $250,000

In this example, FutureTech Innovations Inc. has a positive EVA of $250,000. This means that after covering all its operating expenses and paying for the cost of the capital it uses, the company still generated an additional $250,000 in economic profit. This indicates that FutureTech is creating wealth for its shareholders.

What if NOPAT was only $600,000?

EVA = $600,000 – $750,000 = -$150,000

Even though FutureTech had a positive operating profit ($600,000), its EVA is negative. This means it didn’t earn enough to cover its cost of capital, and it’s destroying shareholder wealth. This highlights the power of EVA: a company can be "profitable" by traditional measures but still be destroying value.

Why EVA Matters: The Benefits of Using This Metric

EVA is more than just another financial calculation; it’s a strategic management tool that offers several significant advantages:

- Aligns with Shareholder Wealth Creation: EVA directly measures the true economic profit that contributes to shareholder wealth. This makes it a powerful metric for assessing whether management decisions are truly adding value.

- Better Performance Measurement: Unlike traditional accounting profits, EVA considers the cost of all capital, including equity. This provides a more accurate picture of a business unit’s or company’s true economic performance.

- Encourages Efficient Capital Use: By explicitly including the cost of capital, EVA incentivizes managers to use capital more efficiently. It makes them think twice before investing in projects that might generate accounting profit but don’t clear the hurdle rate of WACC.

- Improves Decision-Making: EVA can be used in capital budgeting decisions (which projects to invest in), divestiture decisions (which assets to sell), and operational improvements (how to run the business more efficiently). Projects with positive EVA are generally preferred.

- Links to Compensation: Many companies use EVA as a basis for executive and employee compensation. Tying bonuses to EVA encourages managers to make decisions that genuinely create value, rather than just hitting revenue targets or short-term profit goals.

- Promotes Long-Term Thinking: Because EVA focuses on capital efficiency and the true cost of funding, it encourages a more sustainable, long-term approach to business management.

- Identifies Underperforming Assets: By calculating EVA for individual business units or specific assets, companies can pinpoint areas that are destroying value and take corrective action.

EVA vs. Traditional Accounting Metrics (Like Net Profit)

This is a crucial distinction for beginners to grasp.

| Feature | Traditional Net Profit (or Net Income) | Economic Value Added (EVA) |

|---|---|---|

| What it measures | Accounting profit after all explicit expenses (including interest and taxes). | True economic profit after all expenses, including the cost of equity. |

| Cost of Capital | Only considers the explicit cost of debt (interest expense). | Considers the explicit cost of debt and the implicit cost of equity. |

| Focus | Meeting accounting standards and reporting financial performance. | Measuring true value creation for shareholders. |

| Decision Impact | Can encourage maximizing reported profit, even if capital is used inefficiently. | Encourages efficient capital allocation and wealth creation. |

| "Profitability" | A company can be "profitable" but still destroy shareholder wealth. | A positive EVA directly indicates wealth creation. |

The key takeaway is that traditional net profit can be misleading because it doesn’t account for the "opportunity cost" of using shareholder capital. EVA remedies this by explicitly subtracting the WACC.

Who Uses EVA and Why?

EVA is not just a theoretical concept; it’s a practical tool used by a wide range of entities:

- Large Corporations: Many global companies, particularly those focused on maximizing shareholder value, have adopted EVA as a core performance metric. It helps them manage diverse business units and ensure consistent value creation across the organization.

- Private Businesses: Even smaller, privately held companies can benefit from using EVA to assess their capital efficiency and make better investment decisions.

- Investors and Analysts: Investors use EVA to evaluate a company’s financial health and its potential for long-term value creation. A consistently positive and growing EVA can be a strong signal of a well-managed company.

- Management Consultants: Consultants often recommend and help implement EVA frameworks for their clients to improve financial performance and strategic alignment.

Potential Challenges and Limitations of EVA

While powerful, EVA is not without its challenges and limitations:

- Complexity of Calculation: Determining an accurate WACC and making the necessary adjustments to NOPAT and Invested Capital can be complex and require significant financial expertise.

- Data Availability: Small or private companies might struggle to gather all the necessary data points, especially for a precise WACC calculation.

- Historical Focus: EVA is based on historical accounting data. While it informs future decisions, it doesn’t directly predict future performance.

- Ignores Non-Financial Factors: EVA is a purely financial metric. It doesn’t account for important non-financial aspects like customer satisfaction, brand reputation, employee morale, or innovation, which are crucial for long-term success.

- Can Be Misinterpreted: If not properly understood, an over-reliance on EVA for short-term performance targets could lead to under-investment in long-term strategic initiatives or R&D that might not immediately yield positive EVA.

- Dependent on Assumptions: The accuracy of EVA heavily relies on the assumptions made in calculating WACC (e.g., market risk premium, beta) and the adjustments to accounting figures.

Implementing EVA in Your Business

For businesses looking to adopt EVA, here are some general steps:

- Educate Your Team: Ensure that managers and employees understand what EVA is, why it’s important, and how their actions impact it.

- Calculate Your WACC: This is a foundational step. You’ll need to determine your cost of equity and cost of debt, and then weight them appropriately.

- Adjust Financial Statements: Transform traditional accounting numbers into the NOPAT and Invested Capital needed for the EVA calculation. This often involves making adjustments for certain accounting policies (e.g., R&D expensing, deferred taxes) to get a truer economic picture.

- Integrate into Decision-Making: Use EVA as a criterion for evaluating investment projects, assessing business unit performance, and setting strategic goals.

- Link to Compensation: Consider incorporating EVA into performance-based compensation plans to align incentives with wealth creation.

- Monitor and Review: Regularly calculate and analyze EVA to track performance, identify trends, and make necessary adjustments to strategies.

Conclusion: The True Measure of Value Creation

Economic Value Added (EVA) is a sophisticated yet intuitive financial metric that goes beyond traditional accounting profit to reveal a company’s true economic performance. By explicitly accounting for the cost of all capital, including equity, EVA provides a clear answer to whether a business is genuinely creating wealth for its shareholders.

For beginners, understanding EVA means recognizing that "profit" isn’t always enough. True value is created when a company’s operating profits exceed the cost of the money it uses to generate those profits. By focusing on EVA, companies can make more informed decisions, allocate capital more efficiently, and ultimately build more sustainable and valuable enterprises for the long run. Embracing EVA is a step towards a deeper understanding of what drives genuine business success.

Post Comment