Post-Pandemic Global Economic Recovery: A Comprehensive Analysis for Beginners

The COVID-19 pandemic delivered an unprecedented shock to the global economy, forcing lockdowns, disrupting supply chains, and fundamentally changing how we live, work, and consume. Yet, just as quickly as economies shut down, many began a complex and often uneven journey towards post-pandemic global economic recovery.

This comprehensive guide will break down the intricate process of the world’s economic rebound, exploring the key drivers, persistent challenges like inflation and supply chain issues, and the lasting changes shaping our future economy. Whether you’re new to economics or just want a clear picture of what’s happening, this article is designed to make it easy to understand.

The Initial Shock: What Happened When the World Stood Still?

When COVID-19 first emerged, governments around the world implemented strict measures – from travel bans to complete national lockdowns – to curb the virus’s spread. This led to a sudden and severe economic shutdown.

- Businesses closed: Especially those requiring in-person interaction like restaurants, retail stores, and entertainment venues.

- Supply chains broke: Factories couldn’t produce, and shipping became chaotic, leading to shortages of everything from computer chips to toilet paper.

- Job losses soared: Millions were furloughed or laid off as businesses struggled to stay afloat.

- Consumer spending plummeted: People stayed home, uncertain about the future, and unable to spend on many goods and services.

The Response: Governments and central banks acted quickly and decisively.

- Massive Stimulus Packages: Governments injected trillions of dollars into their economies through direct payments to citizens, unemployment benefits, and aid to businesses.

- Low Interest Rates: Central banks (like the U.S. Federal Reserve) slashed interest rates to near zero, making it cheaper for businesses to borrow and invest.

- Quantitative Easing: They also bought vast amounts of government bonds to pump more money into the financial system.

This unprecedented level of support helped prevent a complete economic collapse and set the stage for recovery.

Key Drivers of the Global Economic Recovery

The rebound wasn’t just about government money; several factors converged to fuel the economic rebound we’ve witnessed:

1. Vaccination Efforts and Reopening

The development and rollout of COVID-19 vaccines were game-changers. As vaccination rates increased, countries could gradually lift restrictions, allowing businesses to reopen and people to return to work, travel, and social activities. This re-energized sectors that had been dormant for months.

2. Pent-Up Consumer Demand

After months of lockdowns and limited spending opportunities, consumers accumulated savings. Once restrictions eased, there was a surge in consumer spending, often referred to as "pent-up demand." People were eager to buy goods, travel, and enjoy experiences they had missed.

3. Government Stimulus and Support

The massive fiscal (government spending) and monetary (central bank actions) stimulus packages provided a crucial safety net. They prevented widespread bankruptcies, kept people employed (or provided income during unemployment), and ensured that when the economy reopened, there was money circulating to fuel demand.

4. Digital Acceleration and Innovation

The pandemic forced businesses and individuals to rapidly adopt digital technologies. E-commerce boomed, remote work became mainstream, and digital services (like online learning and telehealth) saw unprecedented growth. This digital transformation created new efficiencies and opportunities, propelling many sectors forward.

5. Resilient Labor Markets (in some regions)

Despite initial job losses, many economies showed remarkable resilience in their labor markets. As businesses reopened, hiring picked up quickly, and unemployment rates began to fall, even reaching pre-pandemic levels in some developed nations.

Enduring Challenges and Headwinds to Recovery

While the recovery has been robust in many areas, it hasn’t been without significant hurdles. These challenges continue to shape the post-pandemic economy:

1. Inflation: The Cost of Living Crisis

Perhaps the most talked-about challenge is inflation – the general increase in prices and fall in the purchasing value of money. Several factors contributed:

- Strong Demand: Too much money (from stimulus) chasing too few goods (due to supply issues).

- Supply Chain Disruptions: Factories couldn’t keep up, and shipping costs soared, making products more expensive to deliver.

- Energy Prices: Geopolitical events (like the war in Ukraine) and increased demand pushed up oil and gas prices, affecting everything from transportation to manufacturing.

- Wage Growth: As workers demanded higher pay to cope with rising costs, businesses passed these costs onto consumers.

Central banks are now raising interest rates to cool down economies and bring inflation under control, but this risks slowing down growth.

2. Persistent Supply Chain Disruptions

Even as demand rebounded, the global supply chains remained "kinked." Issues included:

- Labor Shortages: Not enough truck drivers, port workers, or factory staff.

- Component Shortages: A lack of critical parts like semiconductors (computer chips) for cars, electronics, and appliances.

- Logistical Bottlenecks: Congestion at ports, lack of shipping containers, and increased shipping costs.

These disruptions meant products took longer to reach shelves, and their prices increased.

3. Labor Market Shifts and Shortages

While unemployment fell, many sectors experienced labor shortages. This wasn’t just about people being unwilling to work; it involved:

- The "Great Resignation": Many workers re-evaluated their careers, seeking better pay, benefits, and work-life balance.

- Skill Gaps: The pandemic accelerated the need for digital skills, leaving some traditional roles unfilled.

- Demographic Shifts: Aging populations in some developed countries contribute to a smaller working-age population.

4. Rising Public and Private Debt

Governments borrowed heavily to fund stimulus packages, leading to unprecedented levels of national debt. Businesses and individuals also took on more debt during the crisis. Managing this debt burden, especially as interest rates rise, will be a long-term challenge for many nations.

5. Geopolitical Tensions and Fragmentation

Events like the war in Ukraine have added another layer of complexity, leading to energy price volatility, food security concerns, and a re-evaluation of global trade relationships. This can lead to less globalization and more localized, potentially less efficient, supply chains.

Sectoral Recovery: A Mixed Bag

The global economic recovery has not been uniform across all industries. Some sectors thrived, while others struggled to regain their footing:

- Technology and Digital Services: Boomed as remote work, e-commerce, and online entertainment became essential. Cloud computing, cybersecurity, and software-as-a-service (SaaS) companies saw massive growth.

- E-commerce and Logistics: Online retail soared, putting immense pressure (and opportunity) on delivery services and warehousing.

- Healthcare and Pharmaceuticals: Saw increased investment and demand for everything from vaccines to medical supplies and telehealth services.

- Manufacturing: Faced significant challenges due to supply chain disruptions and component shortages, but demand for goods remained high.

- Travel and Hospitality: Were among the hardest hit initially but saw a gradual, albeit uneven, recovery as borders reopened and people resumed leisure and business travel.

- Retail (Brick-and-Mortar): Faced fierce competition from online retailers, forcing many to adapt or close.

- Energy: Experienced massive fluctuations, from price crashes during lockdowns to sharp increases as demand rebounded and geopolitical tensions rose.

Regional Differences in Recovery

The journey to economic recovery has also varied significantly across different regions of the world:

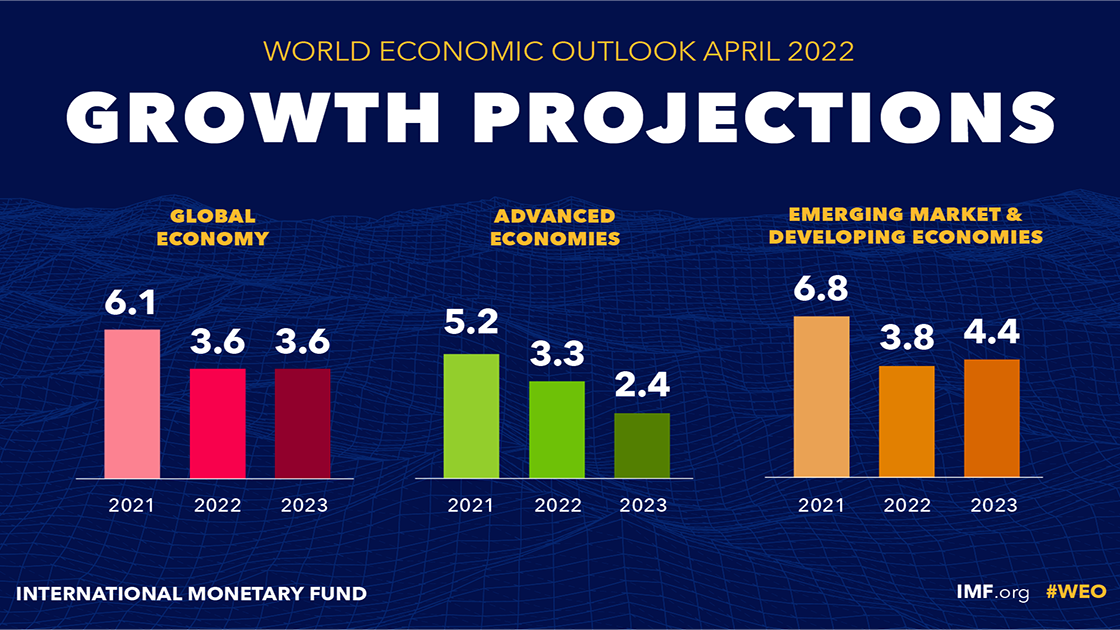

- Developed Economies (e.g., U.S., Europe): Generally had faster access to vaccines, larger fiscal stimulus packages, and more resilient financial systems, leading to quicker initial rebounds. However, they are now grappling with higher inflation and rising interest rates.

- Emerging Markets (e.g., India, Brazil): Often faced greater challenges, including slower vaccine access, limited fiscal space for stimulus, higher vulnerability to commodity price swings, and capital outflows as developed nations raised interest rates.

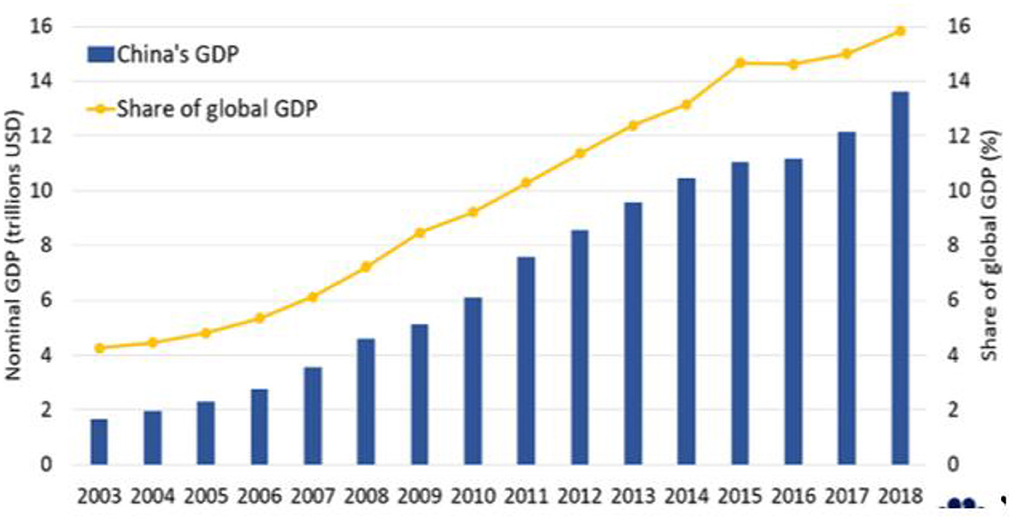

- China: Pursued a strict "zero-COVID" strategy for longer, leading to repeated lockdowns that significantly impacted its economy and global supply chains. Its recovery path has been distinct and more volatile.

- Countries Dependent on Tourism/Commodities: Nations heavily reliant on tourism (e.g., Caribbean islands) or specific commodity exports (e.g., oil producers) experienced unique economic pressures and recovery patterns.

The "New Normal": Lasting Changes to the Global Economy

The pandemic hasn’t just caused a temporary blip; it has accelerated and cemented several long-term trends, shaping the future of the global economy:

- Hybrid and Remote Work: Many companies have adopted permanent hybrid or fully remote work models, impacting urban planning, commercial real estate, and daily commutes.

- Accelerated Digital Transformation: Businesses of all sizes are investing heavily in digital tools, automation, and AI to enhance efficiency and resilience.

- Reshaping Global Supply Chains: Companies are rethinking their reliance on single-source suppliers and "just-in-time" inventory, moving towards more diversified, regionalized, and resilient supply chains (often called "just-in-case" inventory).

- Increased Focus on Health and Well-being: There’s greater public and private investment in healthcare infrastructure, pandemic preparedness, and employee well-being initiatives.

- The Green Economy Push: The pandemic highlighted global interconnectedness and the urgency of climate change. Many recovery plans now include significant investments in renewable energy, sustainable infrastructure, and green technologies.

- E-commerce Dominance: Online shopping is no longer just a convenience; it’s a primary way of buying goods for many consumers, fundamentally altering the retail landscape.

Looking Ahead: Opportunities and Risks

The post-pandemic global economic recovery is an ongoing process, characterized by both immense potential and significant uncertainties.

Opportunities:

- Innovation and Adaptation: The crisis has spurred incredible innovation in technology, healthcare, and business models.

- Digitalization for Efficiency: Widespread digital adoption can lead to greater productivity and new economic opportunities.

- Reshaped Supply Chains: While disruptive, the re-evaluation of supply chains could lead to more robust and less vulnerable global trade networks.

- Green Transition: The push towards sustainable economies could unlock massive investment and job creation in new industries.

Risks:

- Persistent Inflation: If inflation remains stubbornly high, it could erode purchasing power and lead to social unrest.

- Recessionary Pressures: Aggressive interest rate hikes by central banks to combat inflation could tip economies into recession.

- Geopolitical Instability: Ongoing conflicts and trade tensions could further disrupt global markets and supply chains.

- Uneven Recovery: Widening gaps between rich and poor nations, or between different segments of society within countries, could lead to social and political instability.

- New Health Crises: The threat of future pandemics or health emergencies remains, requiring ongoing vigilance and investment.

Conclusion: A Resilient But Evolving Global Economy

The post-pandemic global economic recovery has been a testament to human resilience and adaptability. From the initial shock to the current challenges of inflation and supply chain woes, the world economy has shown a remarkable capacity to bounce back.

However, it’s not a return to the pre-pandemic normal. We are witnessing the birth of a "new normal" – one characterized by accelerated digital transformation, a re-evaluation of global supply chains, heightened awareness of health security, and a growing emphasis on sustainability.

Understanding these complex dynamics is key to navigating the opportunities and challenges that lie ahead. The journey of the world economy continues to evolve, shaped by policy decisions, technological advancements, and the ongoing resilience of businesses and individuals worldwide.

Post Comment