The Cost of Capital: Unlocking the Mystery of WACC Explained for Beginners

Every successful business needs money to grow, innovate, and operate. Whether it’s building a new factory, launching a marketing campaign, or developing a groundbreaking product, capital is the fuel that powers these initiatives. But this money isn’t free. Just like you pay rent for an apartment or interest on a loan, businesses incur a "cost" for the capital they use. This critical concept is known as the Cost of Capital, and the most widely used metric to measure it is the Weighted Average Cost of Capital (WACC).

If terms like "debt," "equity," and "discount rates" sound intimidating, don’t worry. This comprehensive guide will demystify WACC, breaking it down into easy-to-understand components, explaining why it’s crucial for any business, and showing you how it works in plain language.

What Exactly is the Cost of Capital? (Think of it as Rent for Money)

Imagine you want to start a lemonade stand. You need money for lemons, sugar, and a stand. Where do you get it?

- Your Savings (Equity): You use your own money. Even though it’s yours, it still has a "cost." That money could have been earning interest in a savings account or invested elsewhere. This lost opportunity is its cost.

- A Loan from a Friend (Debt): Your friend lends you money, but expects you to pay them back with interest. That interest is the direct cost of using their money.

In the business world, it’s the same, just on a larger scale. Companies raise money primarily through two sources:

- Debt: Borrowing money from banks (loans), issuing bonds to investors, or getting credit from suppliers. The cost here is the interest they pay.

- Equity: Money invested by owners (shareholders), including funds from issuing new shares or retaining past profits. The cost here is the return investors expect to receive for putting their money at risk.

The Cost of Capital is essentially the return a company must earn on its investments to satisfy its lenders and its shareholders. If a project doesn’t generate a return higher than its cost of capital, it’s destroying value for the business.

Introducing WACC: The Ultimate Hurdle Rate

WACC stands for Weighted Average Cost of Capital. It’s not just the cost of debt or the cost of equity; it’s a blended rate that takes into account all the sources of capital a company uses, weighted by their proportion in the company’s capital structure.

Think of it like calculating your average grade in a course where different assignments have different weights. If your final exam is worth 50% and homework is worth 10%, you can’t just average your scores; you have to weight them. WACC does the same for a company’s funding sources.

Why is WACC Called the "Hurdle Rate"?

Imagine a company is considering investing in a new project, like building a new factory. This factory needs to generate enough profit not only to cover its operational expenses but also to pay back its lenders and provide a satisfactory return to its shareholders.

WACC acts as the minimum acceptable rate of return a company must earn on any new project or investment to avoid destroying value for its investors. If a project’s expected return is below the company’s WACC, it’s generally considered a bad investment because it won’t generate enough profit to cover the cost of the money used to fund it. It’s like a runner needing to clear a certain height (the hurdle) to win the race.

In essence, WACC tells a company: "Based on how we fund our operations, this is the lowest acceptable return we can get on our investments without losing money for our investors."

Deconstructing WACC: Its Key Components

To calculate WACC, we need to understand its individual parts:

1. Cost of Debt (Rd)

- What it is: The interest rate a company pays on its borrowed money (loans, bonds).

- Why it’s unique: Interest payments on debt are generally tax-deductible. This means that when a company pays interest, its taxable income decreases, leading to lower tax payments. This tax benefit effectively reduces the true cost of debt for the company.

- Calculating After-Tax Cost of Debt:

- Formula:

Cost of Debt (after-tax) = Interest Rate (Rd) × (1 - Corporate Tax Rate (T)) - Example: If a company borrows at 8% interest and its corporate tax rate is 25%, the after-tax cost of debt is 8% × (1 – 0.25) = 8% × 0.75 = 6%. This 6% is the effective cost of debt to the company.

- Formula:

2. Cost of Equity (Re)

- What it is: The return shareholders expect to receive for investing their money in the company. Unlike debt, there’s no fixed "interest rate" for equity.

- Why it has a "cost":

- Opportunity Cost: Investors could have put their money elsewhere (e.g., in a risk-free government bond or another company). They expect to be compensated for the risk they take by investing in this particular company.

- Shareholder Expectations: If a company doesn’t meet shareholder return expectations, investors might sell their shares, driving down the stock price and making it harder for the company to raise money in the future.

- How it’s estimated (Commonly using CAPM):

- One of the most widely used methods is the Capital Asset Pricing Model (CAPM). It looks at:

- Risk-Free Rate (Rf): The return on a truly risk-free investment (e.g., U.S. Treasury bonds).

- Market Risk Premium (Rm – Rf): The extra return investors expect for investing in the overall stock market compared to a risk-free asset.

- Beta (β): A measure of how volatile a company’s stock is compared to the overall market. A beta of 1 means it moves with the market; >1 means more volatile; <1 means less volatile.

- CAPM Formula:

Cost of Equity (Re) = Risk-Free Rate (Rf) + [Beta (β) × (Market Risk Premium (Rm - Rf))] - Example: If Rf = 3%, Rm = 10%, and β = 1.2, then Re = 3% + [1.2 × (10% – 3%)] = 3% + [1.2 × 7%] = 3% + 8.4% = 11.4%.

- One of the most widely used methods is the Capital Asset Pricing Model (CAPM). It looks at:

- Important Note: Unlike debt, the cost of equity is not tax-deductible. Dividends paid to shareholders are distributed from after-tax profits.

3. Cost of Preferred Stock (Rp) (If applicable)

- What it is: Preferred stock is a hybrid security that has characteristics of both debt and common equity. It pays a fixed dividend, similar to interest on a bond, but it represents ownership.

- Calculating its cost: It’s usually simpler than common equity.

- Formula:

Cost of Preferred Stock (Rp) = Annual Preferred Dividend / Preferred Stock Market Price per Share

- Formula:

- Note: Preferred stock dividends are also not tax-deductible.

4. Weights of Each Capital Source (Wd, We, Wp)

- What they are: The proportion of each type of capital (debt, equity, preferred stock) in the company’s overall capital structure.

- Crucial point: These weights must be based on market values, not book values (the historical cost recorded on the balance sheet). Market values reflect the current worth of the company’s debt and equity in the financial markets.

- Market Value of Equity (E): Number of outstanding shares × Current share price.

- Market Value of Debt (D): The current market value of all outstanding debt (e.g., bond prices, loan principal).

- Market Value of Preferred Stock (P): Number of preferred shares × Current preferred share price.

- Calculating Weights:

Total Capital (V) = E + D + PWeight of Equity (We) = E / VWeight of Debt (Wd) = D / VWeight of Preferred Stock (Wp) = P / V- The sum of all weights must equal 1 (or 100%).

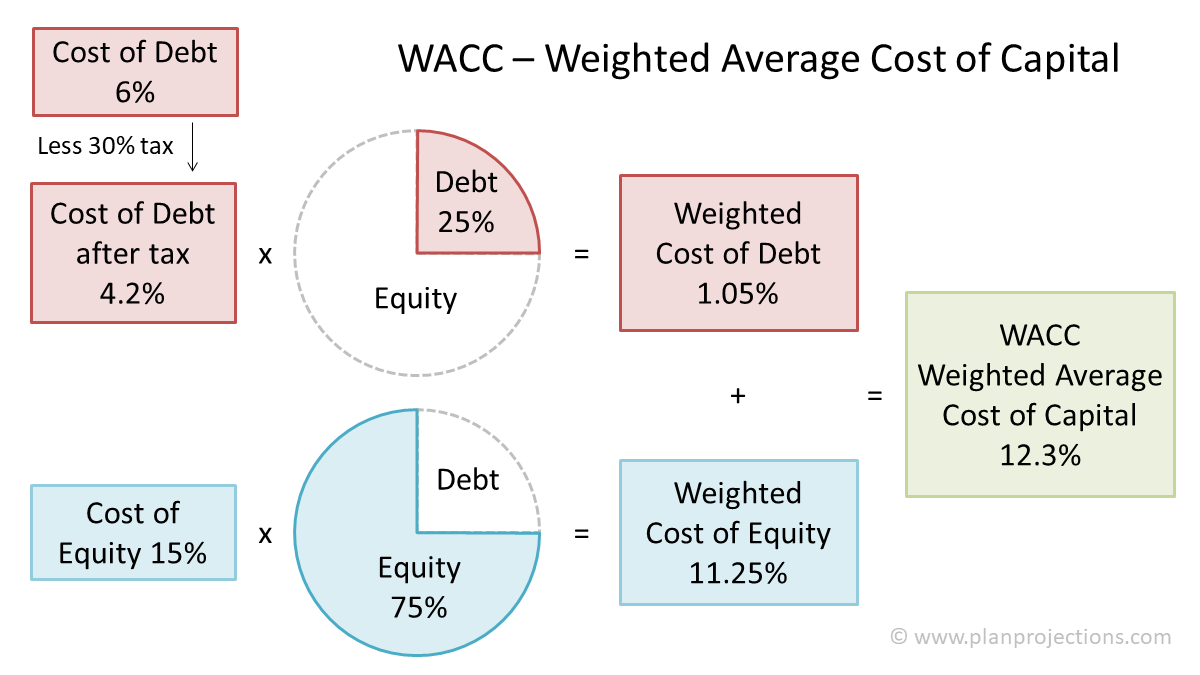

Putting it All Together: The WACC Formula

Once you have all the components, calculating WACC is straightforward:

WACC = (We × Re) + (Wd × Rd × (1 – T)) + (Wp × Rp)

Where:

- We = Weight of Equity (Market Value of Equity / Total Market Value of Capital)

- Re = Cost of Equity

- Wd = Weight of Debt (Market Value of Debt / Total Market Value of Capital)

- Rd = Cost of Debt (Interest Rate)

- T = Corporate Tax Rate

- Wp = Weight of Preferred Stock (Market Value of Preferred Stock / Total Market Value of Capital)

- Rp = Cost of Preferred Stock

A Step-by-Step WACC Calculation Example (Simplified)

Let’s imagine a hypothetical company, "GreenTech Innovations," that wants to calculate its WACC.

Given Information:

- Equity:

- Number of outstanding shares: 1,000,000

- Current share price: $50 per share

- Cost of Equity (Re): 12% (estimated using CAPM)

- Debt:

- Total market value of outstanding debt: $30,000,000

- Average interest rate on debt (Rd): 7%

- Corporate Tax Rate (T): 25%

- Preferred Stock: (For simplicity, let’s assume GreenTech Innovations does not have preferred stock in this example. If it did, we’d add its component.)

Let’s calculate GreenTech Innovations’ WACC:

Step 1: Calculate the Market Value of Each Capital Component

- Market Value of Equity (E): 1,000,000 shares × $50/share = $50,000,000

- Market Value of Debt (D): $30,000,000

- Market Value of Preferred Stock (P): $0 (as assumed)

Step 2: Calculate the Total Market Value of Capital (V)

- V = E + D + P

- V = $50,000,000 + $30,000,000 + $0 = $80,000,000

Step 3: Calculate the Weights of Each Capital Component

- Weight of Equity (We): $50,000,000 / $80,000,000 = 0.625 (or 62.5%)

- Weight of Debt (Wd): $30,000,000 / $80,000,000 = 0.375 (or 37.5%)

- (Check: 0.625 + 0.375 = 1.00)

Step 4: Calculate the After-Tax Cost of Debt

- After-Tax Rd = Rd × (1 – T)

- After-Tax Rd = 7% × (1 – 0.25) = 7% × 0.75 = 0.0525 (or 5.25%)

Step 5: Apply the WACC Formula

Since there’s no preferred stock, our formula simplifies to:

WACC = (We × Re) + (Wd × After-Tax Rd)

- WACC = (0.625 × 0.12) + (0.375 × 0.0525)

- WACC = 0.075 + 0.0196875

- WACC = 0.0946875

Step 6: Interpret the Result

- WACC = 9.47% (approximately)

This means that for GreenTech Innovations, the average cost of every dollar it uses to fund its operations is approximately 9.47%. Therefore, any new project or investment GreenTech considers should ideally generate an expected return greater than 9.47% to create value for its shareholders. If a project yields less than 9.47%, it’s not covering the company’s cost of capital and should likely be rejected.

Why WACC Matters: The Power of the Hurdle Rate in Action

WACC is far more than just a theoretical number; it’s a practical and powerful tool used across various aspects of business finance:

-

Capital Budgeting Decisions (Project Selection):

- This is the primary use. Companies use WACC as the discount rate to evaluate potential projects and investments.

- Techniques like Net Present Value (NPV) and Internal Rate of Return (IRR) rely heavily on WACC.

- Rule of Thumb: If a project’s expected return (IRR) is higher than the WACC, or its NPV is positive when discounted by WACC, it’s generally a good investment. If not, it’s likely a value-destroying venture.

-

Company Valuation:

- WACC is a key input in many company valuation models, particularly the Discounted Cash Flow (DCF) model.

- It’s used to discount a company’s projected future free cash flows back to their present value, giving an estimate of the company’s intrinsic worth. A lower WACC leads to a higher valuation, and vice-versa.

-

Strategic Decisions:

- Mergers & Acquisitions (M&A): When one company considers acquiring another, it uses WACC to evaluate the target company’s value and the potential synergies.

- Divestitures: Similarly, WACC can help determine if spinning off a division or selling an asset makes financial sense.

- Capital Structure Decisions: Understanding WACC helps companies decide on the optimal mix of debt and equity to minimize their overall cost of capital and maximize firm value.

-

Performance Measurement:

- WACC can be used to set performance targets for divisions or business units. A division should aim to generate returns higher than the company’s WACC.

- It’s a benchmark for evaluating management’s effectiveness in deploying capital.

Limitations and Practical Considerations of WACC

While WACC is an indispensable tool, it’s important to be aware of its limitations:

- Estimation Challenges: Accurately estimating the cost of equity (especially beta and market risk premium) and the market value of debt can be difficult, as these inputs often require judgment and rely on market data that can fluctuate.

- Assumptions: WACC assumes that the company’s capital structure (the mix of debt and equity) remains constant over the life of the project being evaluated. It also assumes the project has similar risk to the company’s existing operations.

- Single Rate for All Projects: Using a single WACC for all projects can be problematic if projects have significantly different risk profiles. A higher-risk project should ideally be evaluated with a higher discount rate than a lower-risk one.

- Market Fluctuations: Interest rates, stock prices, and investor expectations change constantly, meaning WACC is not a static number. It needs to be regularly re-evaluated.

- Flotation Costs: The costs associated with issuing new debt or equity (e.g., underwriting fees, legal fees) are sometimes incorporated into WACC calculations but can make it more complex.

- Private Companies: Calculating WACC for private companies can be particularly challenging due to the lack of publicly traded stock prices and readily available market data for debt.

Conclusion: WACC – Your Compass for Smart Investment Decisions

The Weighted Average Cost of Capital (WACC) is a cornerstone of corporate finance. It provides a vital benchmark, acting as a "hurdle rate" that guides a company’s investment decisions. By understanding how much it truly costs to finance its operations, a business can make informed choices about which projects to pursue, how to structure its capital, and ultimately, how to create and maximize value for its shareholders.

While calculating WACC involves several components and assumptions, its core principle is simple: if your investments don’t generate returns higher than the cost of the money you used to fund them, you’re on a path to value destruction. Mastering WACC is a crucial step for anyone looking to understand how businesses make strategic financial decisions and drive sustainable growth.

Frequently Asked Questions (FAQs) About WACC

1. Is a lower WACC better?

Generally, yes! A lower WACC means it costs less for a company to raise capital. This allows the company to invest in more projects, potentially increasing its profitability and value. Companies strive to optimize their capital structure to achieve the lowest possible WACC without taking on excessive risk.

2. Does WACC change over time?

Absolutely. WACC is dynamic. It changes due to:

- Fluctuations in market interest rates (affecting the cost of debt).

- Changes in stock prices or investor expectations (affecting the cost of equity).

- A company’s capital structure changing (e.g., issuing new debt or equity).

- Changes in the corporate tax rate.

3. Can a private company calculate WACC?

Yes, but it’s more challenging. Private companies lack publicly traded stock prices, making it harder to determine the market value and cost of equity. They often rely on:

- Industry averages for beta.

- Valuation models that use comparable public companies.

- Estimates of market value of debt.

Despite the difficulty, calculating WACC is still crucial for private companies to make sound investment decisions.

4. What is the difference between WACC and the discount rate?

In the context of evaluating a company’s overall projects or a company’s entire value, WACC is the primary discount rate used. However, the term "discount rate" is broader. For a specific project that has a different risk profile than the company’s average operations, a project-specific discount rate might be used, which could be higher or lower than the company’s overall WACC.

5. Why is the cost of debt tax-deductible but the cost of equity isn’t?

Interest payments on debt are considered an expense of doing business by tax authorities, so they reduce a company’s taxable income. Dividends paid to shareholders (a component of the cost of equity) are considered a distribution of profits after taxes have been paid. This tax shield for debt is a significant reason why debt is often a cheaper source of capital than equity.

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Post Comment