Understanding Economic Cycles: Boom and Bust in Global Economies – A Beginner’s Guide

Have you ever wondered why sometimes it’s easy to find a job and prices seem to be going up, while at other times jobs are scarce and businesses struggle? This isn’t just random chance; it’s often the ebb and flow of economic cycles, a fundamental concept in understanding how global economies function.

Think of an economy like the seasons: there’s a time of growth and prosperity (summer), a peak, a period of decline (autumn), and a low point (winter), before the cycle begins anew. These are the "boom and bust" phases that characterize economic life.

Understanding these cycles is crucial for everyone – from individuals making financial decisions to businesses planning for the future, and even governments setting policies. In this comprehensive guide, we’ll break down the complexities of economic cycles into easy-to-understand terms, exploring their phases, causes, and how they impact our interconnected world.

What Are Economic Cycles? The Rhythmic Pulse of the Economy

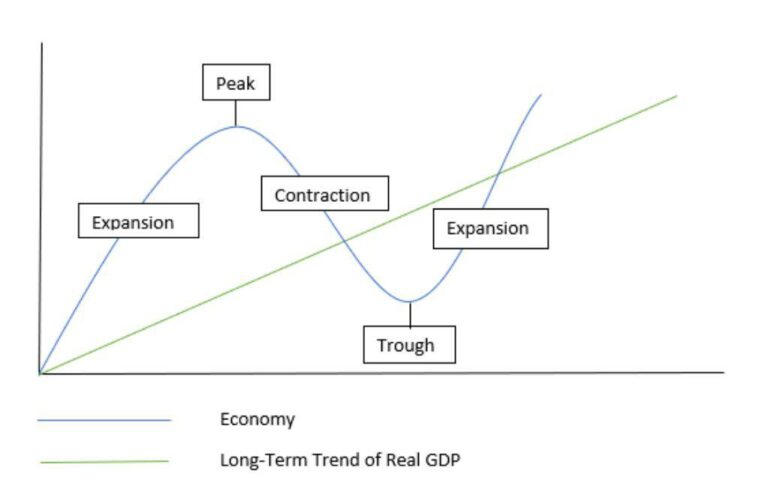

At its core, an economic cycle, also known as a business cycle, refers to the natural fluctuations in economic activity that an economy experiences over a period of time. These fluctuations are not regular or predictable in their exact timing or duration, but they generally follow a pattern of expansion and contraction.

Imagine a rollercoaster: it climbs, reaches a peak, dips down, hits a low point, and then starts climbing again. That’s a good analogy for the four main phases of an economic cycle:

-

Expansion (The "Boom"): This is the good times!

- What it looks like: The economy is growing, jobs are plentiful, consumer spending is high, and businesses are investing and expanding. People feel optimistic, and incomes generally rise.

- Key characteristics: Rising Gross Domestic Product (GDP), low unemployment rates, increasing wages, strong stock markets, and often, rising inflation (prices going up).

-

Peak: The top of the rollercoaster.

- What it looks like: The economy has reached its maximum growth. Businesses are operating at full capacity, unemployment is at its lowest point, and prices might be rising rapidly.

- Key characteristics: Often characterized by unsustainable growth, asset bubbles (where prices of things like houses or stocks become inflated beyond their real value), and sometimes, a feeling that things can only go up.

-

Contraction (The "Bust" or Recession): The rollercoaster starts to go down.

- What it looks like: Economic activity slows down. Businesses might cut back on production, lay off workers, and consumer spending declines. People become more cautious.

- Key characteristics: Falling GDP, rising unemployment, declining consumer confidence, lower corporate profits, and often, a decrease in inflation or even deflation (prices falling). A recession is typically defined as two consecutive quarters (six months) of negative GDP growth.

-

Trough: The bottom of the rollercoaster.

- What it looks like: The economy has hit its lowest point. Unemployment is high, businesses are struggling, and consumer spending is very low. This is the turning point where the economy starts to recover.

- Key characteristics: High unemployment, low demand, often very low inflation or deflation. This phase is usually brief, as conditions eventually become ripe for recovery and the cycle begins anew with expansion.

Why Do Economic Cycles Happen? The Driving Forces

Economic cycles aren’t caused by a single factor but are a complex interplay of various forces. Understanding these drivers helps us see why the economy rarely stays flat for long.

-

Consumer Spending and Business Investment: These are the biggest engines of an economy.

- Boom: When consumers feel confident, they spend more. When businesses see demand, they invest in new equipment, factories, and hire more people. This creates a positive feedback loop, fueling growth.

- Bust: If confidence drops, consumers cut back, and businesses stop investing. This leads to job losses, which further reduces spending, creating a downward spiral.

-

Interest Rates and Credit Availability: How easy or expensive it is to borrow money.

- Boom: Low interest rates make it cheaper for businesses to borrow and expand, and for consumers to buy homes or cars on credit, stimulating growth.

- Bust: If interest rates rise too high, borrowing becomes expensive, slowing down investment and spending. A lack of available credit can also halt economic activity.

-

Technological Innovation: New inventions can spark massive growth.

- Boom: Breakthroughs (like the internet or artificial intelligence) can create entirely new industries, jobs, and investment opportunities, driving long periods of expansion.

- Bust: The initial excitement might lead to over-investment (like the dot-com bubble), followed by a correction when the real economic value catches up.

-

Government Policy (Fiscal and Monetary): Governments and central banks actively try to influence the economy.

- Fiscal Policy: Decisions about government spending (e.g., infrastructure projects, social programs) and taxation. Increased spending or tax cuts can stimulate a slow economy.

- Monetary Policy: Actions by the central bank (like the Federal Reserve in the U.S.) to control the money supply and interest rates. Lowering interest rates encourages borrowing and spending; raising them slows it down.

- Impact: These policies can either amplify or dampen economic cycles, though their effectiveness and timing are constantly debated.

-

External Shocks: Unexpected events can dramatically impact the economy.

- Examples: Natural disasters (hurricanes, pandemics), wars, sudden changes in oil prices, or financial crises originating in other countries.

- Impact: These shocks can abruptly push an economy into a contraction or slow down an expansion.

-

Psychology and Expectations ("Animal Spirits"): Human emotions play a surprisingly large role.

- Boom: Widespread optimism can lead to increased risk-taking, investment, and spending, even if underlying fundamentals aren’t perfectly aligned.

- Bust: Conversely, pessimism and fear can lead to people hoarding cash, reducing investment, and slowing down the economy even further. Economists sometimes call these collective sentiments "animal spirits."

The "Boom": Understanding Expansion and Peak

The expansion phase is when the economy is thriving. It’s a time of optimism, growth, and opportunity.

-

Characteristics of the Boom:

- High Employment: Companies are hiring, and unemployment rates are low. It’s easier to find a job, and wages may start to rise as companies compete for workers.

- Increased Consumer Spending: People have more disposable income and feel confident about the future, leading them to spend more on goods and services, from cars to vacations.

- Business Growth and Investment: Companies see strong demand and high profits, prompting them to invest in new equipment, technology, and expand their operations. New businesses are often formed.

- Rising Asset Prices: Stock markets tend to perform well, and real estate prices can increase due to strong demand and easily available credit.

- Inflationary Pressure: As demand for goods and services outstrips supply, prices tend to rise. This is called inflation. Moderate inflation (around 2-3% per year) is often seen as a sign of a healthy, growing economy.

-

Potential Pitfalls of the Boom:

- Overheating: If growth becomes too rapid, inflation can accelerate out of control, eroding the purchasing power of money.

- Asset Bubbles: Excessive optimism can lead to speculation, where asset prices (like housing or tech stocks) rise far beyond their true value. When these bubbles burst, it can trigger a sharp downturn.

- Unsustainable Debt: During a boom, individuals, businesses, and even governments might take on too much debt, assuming future prosperity will make repayment easy. This can become a major problem during a downturn.

The "Bust": Navigating Contraction and Trough

The contraction phase, often leading to a recession, is the challenging part of the economic cycle. It’s when economic activity slows down significantly.

-

Characteristics of the Bust:

- Falling GDP: The overall output of goods and services in the economy declines.

- Rising Unemployment: Businesses reduce production, leading to layoffs. It becomes harder to find jobs, and people worry about job security.

- Decreased Consumer Spending: With less income and more uncertainty, consumers cut back on non-essential spending.

- Business Failures: Companies struggle with lower demand and profits, leading to bankruptcies and closures.

- Falling Asset Prices: Stock markets typically decline, and real estate values may drop.

- Deflationary Pressures: If demand falls sharply, businesses might lower prices to attract customers, leading to deflation. While falling prices might sound good, widespread deflation can be very damaging, as it discourages spending and investment.

-

Recession vs. Depression:

- A recession is a significant decline in economic activity spread across the economy, lasting more than a few months. It’s marked by a downturn in real GDP, real income, employment, industrial production, and wholesale-retail sales.

- A depression is a more severe and prolonged recession, characterized by an extreme drop in economic activity, very high unemployment, and widespread business failures. The Great Depression of the 1930s is the most famous example. Fortunately, depressions are rare.

-

Why the Bust Can Be Necessary (A "Cleansing"):

- While painful, a downturn can sometimes act as a "cleansing" process for the economy.

- Correction of Excesses: It helps eliminate unsustainable business models, reduce excessive debt, and bring asset prices back to more realistic levels after a bubble.

- Increased Efficiency: Companies that survive often become leaner and more efficient, preparing them for the next expansion.

- Lower Inflation: Recessions often help bring down high inflation rates that built up during the boom.

Government and Central Bank Roles in Managing Cycles

Governments and central banks don’t just sit back and watch economic cycles unfold. They actively try to moderate the swings, aiming for stable growth and low unemployment.

-

Central Banks and Monetary Policy:

- Who they are: Independent institutions (like the Federal Reserve in the U.S., the European Central Bank in Europe, or the Bank of England in the UK) responsible for managing a country’s money supply and interest rates.

- Their Tools:

- Interest Rates: Their primary tool.

- During a Bust (Stimulate): They lower interest rates. This makes borrowing cheaper for businesses (encouraging investment) and consumers (encouraging spending on homes, cars, etc.).

- During a Boom (Cool Down): They raise interest rates. This makes borrowing more expensive, slowing down spending and investment to prevent overheating and control inflation.

- Quantitative Easing (QE) / Quantitative Tightening (QT): In extreme situations (like after a major crisis), central banks might buy large amounts of government bonds or other assets (QE) to inject money directly into the financial system and lower long-term interest rates. QT is the reverse, selling assets to remove money from the system.

- Interest Rates: Their primary tool.

- Goals: Their main goals are typically price stability (keeping inflation under control) and maximum sustainable employment.

-

Governments and Fiscal Policy:

- Who they are: The elected government (e.g., Congress and the President in the U.S.).

- Their Tools:

- Government Spending:

- During a Bust (Stimulate): Increase spending on infrastructure projects (roads, bridges), social programs, or direct payments to citizens. This injects money into the economy and creates jobs.

- During a Boom (Cool Down): Reduce government spending, though this is less common politically.

- Taxation:

- During a Bust (Stimulate): Cut taxes on individuals or businesses, leaving them with more money to spend or invest.

- During a Boom (Cool Down): Raise taxes, which takes money out of the economy, but again, this is often politically unpopular.

- Government Spending:

- Goals: Fiscal policy aims to influence aggregate demand and achieve economic stability, but it’s often slower to implement than monetary policy due to political processes.

-

Challenges in Managing Cycles:

- Timing: It’s hard to predict exactly when a cycle will turn, and policies often have a delayed effect.

- Magnitude: How much to intervene? Too much or too little can worsen the situation.

- Political Constraints: Fiscal policy decisions are often influenced by political considerations rather than purely economic ones.

- Global Interconnectedness: One country’s policies can affect others, and global events can override domestic efforts.

Impact on Global Economies: A World Interconnected

In today’s world, economies are highly interconnected through trade, finance, and information flows. This means that economic cycles rarely happen in isolation within a single country.

- Trade: If a major economy like the U.S. or China enters a recession, its demand for goods and services from other countries falls. This can significantly impact the export-driven economies that supply them. For example, a U.S. recession might hurt manufacturing in Germany or Asia.

- Financial Markets: Stock markets, bond markets, and currency markets are globally linked. A financial crisis in one major financial center can quickly spread worldwide as investors pull money out of risky assets or countries. The 2008 global financial crisis is a stark example, originating in the U.S. housing market but quickly impacting banks and economies worldwide.

- Investment Flows: Companies and investors move capital across borders. During a boom, foreign investment can pour into a country, fueling its growth. During a bust, capital can flee, putting pressure on a country’s currency and financial system.

- Commodity Prices: Global demand and supply for commodities like oil, metals, and agricultural products directly influence their prices. A global boom will push up demand and prices, while a global bust will cause them to fall, impacting countries that are major exporters or importers of these goods.

- Contagion: Economic problems can spread like a virus. A banking crisis in one country might cause panic in another, leading to a loss of confidence and capital flight, even if the second country’s fundamentals were initially sound.

This interconnectedness highlights why international cooperation and understanding are so important in navigating global economic cycles.

Navigating the Cycles: What You Can Do

While we can’t stop economic cycles, understanding them empowers us to make better decisions, whether you’re an individual, a business owner, or a policymaker.

For Individuals:

- Build an Emergency Fund: Save 3-6 months (or more) of living expenses. This provides a crucial buffer if you lose your job during a recession.

- Diversify Investments: Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and industries. This helps cushion the blow if one sector performs poorly.

- Avoid Excessive Debt: While debt can be useful for investments like a home, too much high-interest debt (like credit card debt) can be crippling during a downturn when incomes might fall.

- Continuous Learning: Keep your skills updated and adaptable. Industries change, and new skills can make you more resilient in the job market.

- Long-Term Perspective: Don’t panic during market downturns. History shows that economies always recover, and markets tend to rise over the long term.

For Businesses:

- Maintain Financial Prudence: Build cash reserves during the boom times. Avoid over-leveraging (taking on too much debt) when credit is cheap.

- Diversify Revenue Streams: Don’t rely on a single product, service, or customer.

- Focus on Efficiency and Innovation: During a downturn, efficient businesses with innovative offerings are more likely to survive and thrive.

- Be Flexible: Adapt to changing market conditions quickly. This might mean adjusting production, marketing strategies, or staffing levels.

- Manage Inventory Wisely: Avoid building up too much inventory during an expansion, as it can become a liability during a contraction.

- Invest Strategically: While it sounds counter-intuitive, recessions can be a good time to acquire assets or invest in R&D at lower costs, positioning for the next upturn.

Conclusion: The Unavoidable Rhythm of Economic Life

Economic cycles, with their phases of boom and bust, are a natural and unavoidable part of how global economies function. They are driven by a complex mix of human behavior, technological advancements, government policies, and external events.

While the "bust" phases can be challenging and sometimes painful, they also serve to rebalance the economy and set the stage for the next period of growth. By understanding these cycles – recognizing the signs of expansion and contraction, appreciating the role of central banks and governments, and acknowledging the interconnectedness of nations – we can better prepare ourselves.

Instead of fearing the inevitable downturns, we can learn to anticipate them, mitigate their impact, and even find opportunities within them. Ultimately, knowledge about economic cycles empowers us to make more informed decisions, leading to greater financial resilience and a clearer perspective on the ever-evolving landscape of our global economy.

Post Comment