Debt vs. Equity Financing: A Definitive Comparison for Navigating Your Business Funding Options

Every business, from a budding startup to a sprawling enterprise, eventually faces a crucial question: how do we fund our growth? The answer often boils down to two primary methods: Debt Financing and Equity Financing. While both are vital for raising capital, they operate on fundamentally different principles, each with its own set of advantages and disadvantages.

Understanding these differences is not just for finance experts; it’s essential for every entrepreneur and business owner. Making the right choice can significantly impact your company’s control, risk, future growth, and overall financial health.

In this definitive comparison, we’ll break down Debt vs. Equity Financing in easy-to-understand terms, helping you navigate your business funding options with confidence.

What is Debt Financing? The Borrower’s Path

Imagine you need money, and you go to a bank or a friend and ask for a loan. You promise to pay them back the original amount (the principal) plus an additional fee (the interest) over a set period. This, in essence, is debt financing.

Debt financing involves borrowing money from a lender with the promise to repay it, usually with interest, within a specific timeframe. When you take on debt, you don’t give up any ownership or control of your company. You remain the sole owner, but you take on a financial obligation.

Key Characteristics of Debt Financing:

- Borrowing Money: You receive a lump sum of cash.

- Repayment Obligation: You are legally bound to pay back the principal plus interest.

- Interest Payments: This is the cost of borrowing money, often tax-deductible for businesses.

- Fixed Term: Loans typically have a defined repayment schedule (e.g., 5 years, 10 years).

- No Ownership Dilution: Lenders do not get a stake in your company or a say in its operations beyond ensuring repayment terms are met.

- Collateral (Often Required): Lenders may require assets (like property, equipment, or inventory) as security. If you default, they can seize these assets.

Common Sources of Debt Financing:

- Bank Loans: Traditional loans from commercial banks (term loans, lines of credit).

- SBA Loans: Loans guaranteed by the Small Business Administration (SBA), often with more favorable terms.

- Lines of Credit: Flexible borrowing where you can draw funds as needed, up to a certain limit, and only pay interest on the amount used.

- Venture Debt: A specialized form of debt for venture-backed companies, often less restrictive than traditional bank loans.

- Credit Cards: While easy to access, business credit cards typically carry very high interest rates and are best for short-term, small needs.

- Bonds: For larger, more established companies, issuing bonds directly to investors is a form of debt.

Advantages of Debt Financing:

- Retain Full Ownership & Control: This is the biggest draw. You don’t give up any part of your company or decision-making power.

- Predictable Payments: You know exactly how much you need to pay back and when, making financial planning easier.

- Tax Deductible Interest: In many jurisdictions, the interest paid on business loans is a tax-deductible expense, reducing your overall tax burden.

- Lower Cost (Potentially): For stable, profitable businesses, the cost of debt (interest rate) can often be lower than the long-term cost of giving up equity.

- Leverage for Growth: Debt can be used to amplify returns on investment. If you borrow at 5% and your investment generates 15%, you’ve effectively increased your profit.

Disadvantages of Debt Financing:

- Repayment Obligation (Even in Hard Times): Regardless of your business’s performance, you must make your loan payments. Failure to do so can lead to default, damage to your credit, and even bankruptcy.

- Collateral Requirements: Many lenders require assets as security, putting your business or personal assets at risk.

- Restrictive Covenants: Lenders may impose conditions (covenants) that limit your business activities, such as limits on executive salaries, additional debt, or asset sales.

- Impact on Credit Score: Your business credit score (and sometimes personal) is heavily influenced by your debt repayment history.

- Difficulty for New Businesses: Startups or businesses with unpredictable cash flows may find it challenging to secure traditional debt financing.

- Debt Burden: Too much debt can make your company financially fragile and unable to take on new opportunities.

What is Equity Financing? The Partner’s Path

Instead of borrowing money, imagine you’re willing to share a piece of your company with someone in exchange for their investment. This is equity financing.

Equity financing involves selling a portion of your company’s ownership (shares or stock) to investors in exchange for capital. These investors become part-owners of your business and, in return, share in its future profits and potential growth. Unlike debt, there’s no obligation to repay the money.

Key Characteristics of Equity Financing:

- Selling Ownership: You give up a percentage of your company.

- No Repayment Obligation: You do not have to pay back the invested capital.

- Profit Sharing: Investors benefit if the company becomes profitable or increases in value.

- Shared Risk: Investors share in the risks of the business. If the company fails, they lose their investment.

- Potential for Control Dilution: As you sell more equity, you may give up some control or influence over major business decisions.

- Exit Strategy: Investors typically look for a future event (like an acquisition or IPO) where they can sell their shares for a significant return.

Common Sources of Equity Financing:

- Bootstrapping/Personal Savings: While not external, using your own money is the purest form of equity (100% ownership retained).

- Friends & Family: Often the first external investors, willing to take a higher risk based on trust.

- Angel Investors: High-net-worth individuals who invest their own money, often in early-stage startups, and may offer mentorship.

- Venture Capital (VC) Firms: Professional investment firms that pool money from various sources to invest in high-growth potential companies, usually in exchange for significant equity and often a board seat.

- Crowdfunding (Equity-Based): Raising small amounts of capital from a large number of individuals online in exchange for equity.

- Private Equity Firms: For more mature, established companies, private equity firms often invest large sums for significant control, aiming to restructure and improve the business before selling it.

- Public Stock Markets (IPO): For very large, established companies, going public by listing shares on a stock exchange is a major form of equity financing.

Advantages of Equity Financing:

- No Repayment Obligation: This is a huge relief, especially for startups with uncertain cash flows. You don’t have monthly payments hanging over your head.

- Shared Risk: Investors share in the financial risk. If the business struggles, you’re not solely on the hook for repayment.

- Strategic Partnerships & Expertise: Many equity investors (especially angels and VCs) bring valuable industry experience, mentorship, connections, and strategic guidance beyond just money.

- No Collateral Required: You don’t need to pledge assets as security.

- Boost to Credibility: Attracting reputable equity investors can enhance your company’s image and open doors to future funding or partnerships.

- Long-Term Capital: Equity often provides patient capital, allowing businesses to focus on long-term growth without immediate pressure for short-term profits to cover debt payments.

Disadvantages of Equity Financing:

- Loss of Ownership & Control (Dilution): Every time you sell equity, your percentage of ownership decreases. This means less control over decisions and a smaller share of future profits.

- High Expectations & Pressure: Investors, especially VCs, expect significant returns (often 10x or more) within a specific timeframe, putting immense pressure on management.

- Decision-Making Interference: Investors, particularly those with significant stakes or board seats, will have a say in major business decisions, which can sometimes lead to conflicts.

- Complex & Time-Consuming Process: Attracting equity investors, especially VCs, involves extensive due diligence, negotiations, and legal work.

- Valuation Challenges: Determining a fair valuation for a young company can be difficult, and you might end up selling equity for less than it’s truly worth.

- Loss of Confidentiality: You’ll need to share sensitive business information with potential investors.

- Future Dilution: Future rounds of equity financing will further dilute your ownership stake.

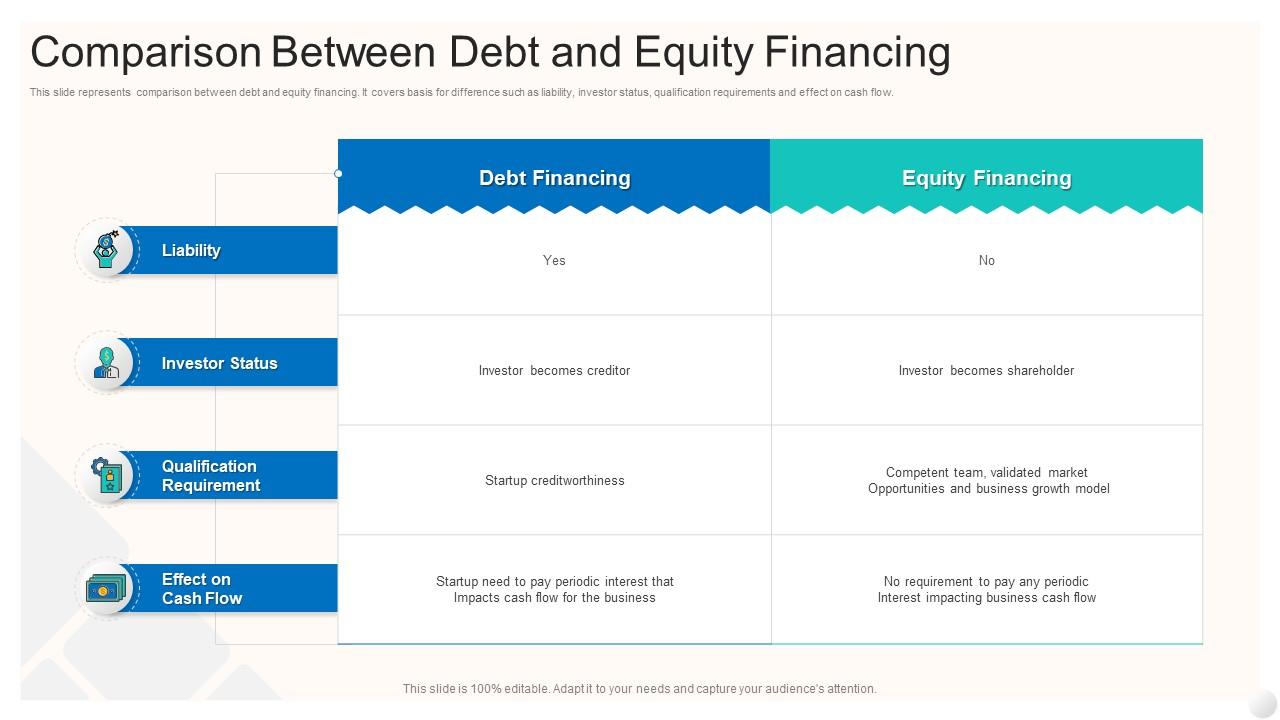

Debt vs. Equity: A Side-by-Side Comparison

To truly grasp the differences, let’s look at a direct comparison:

| Feature | Debt Financing | Equity Financing |

|---|---|---|

| Ownership/Control | Retain 100% ownership and control. | Give up a percentage of ownership; may lose some control. |

| Repayment | Required: Principal + Interest on a schedule. | Not required: Investors get returns from profit/exit. |

| Cost | Interest payments (tax-deductible). | Share of future profits/company value; dilution. |

| Risk to Business | Default leads to asset seizure, bankruptcy. | No default risk; loss of control/future upside. |

| Flexibility | Less flexible; fixed payments. May have covenants. | More flexible; no fixed payments. |

| Speed | Can be quicker for established businesses. | Often a longer, more complex process. |

| Investor Role | Lender has no operational say (beyond covenants). | Investor often gets a say, mentorship, connections. |

| Suitable For | Established businesses, predictable cash flow, short-term needs, lower risk tolerance. | High-growth potential, startups, uncertain cash flow, need for expertise, willing to share control. |

| Tax Implications | Interest is often tax-deductible. | No direct tax deduction for capital received. |

| Security | Often requires collateral. | No collateral required. |

| Exit Strategy | Loan is repaid; relationship ends. | Investor seeks a future liquidity event (acquisition, IPO). |

When to Choose Debt Financing?

Debt financing is often the preferred choice in specific scenarios:

- You want to maintain full control: If preserving 100% ownership and decision-making power is paramount, debt is your answer.

- Your business has predictable cash flow: Lenders prefer to see a stable income stream that can reliably cover loan payments.

- You have valuable assets for collateral: Having assets to pledge can make it easier to secure a loan and potentially get better terms.

- You need funds for a specific, short-term project: Debt is excellent for purchasing equipment, expanding inventory, or bridging a temporary cash flow gap.

- Your business is established and profitable: Lenders are more willing to provide capital to businesses with a proven track record.

- You can benefit from tax deductions: The interest paid on debt can reduce your taxable income.

When to Choose Equity Financing?

Equity financing shines in different situations:

- You’re a high-growth startup with uncertain cash flow: Investors understand that early-stage companies may not be profitable immediately and are willing to wait for a significant return.

- You need more than just money: If you’re looking for strategic guidance, industry connections, or mentorship from experienced investors, equity can provide that.

- You have a groundbreaking idea but no assets for collateral: Many startups are asset-light, making debt financing difficult.

- You’re willing to share control for rapid scaling: If your goal is aggressive growth that requires substantial capital and expertise, giving up some ownership can be a worthwhile trade-off.

- Your business is in an industry favored by venture capitalists: Certain sectors (tech, biotech, SaaS) are magnets for equity investment due to their high growth potential.

- You want to share the risk: If the business fails, you’re not solely responsible for repaying a loan.

Hybrid Approaches: Blending Debt and Equity

It’s important to note that the world of finance isn’t always black and white. Many companies utilize a combination of debt and equity over their lifecycle. Some common hybrid approaches include:

- Convertible Notes/SAFEs (Simple Agreement for Future Equity): These are initially debt instruments that convert into equity at a later funding round, often used by early-stage startups. They provide immediate cash without setting a valuation upfront.

- Venture Debt: A type of debt specifically for venture-backed companies. It’s less dilutive than equity but still provides capital, often acting as a bridge between equity rounds.

- Revenue-Based Financing: Investors provide capital in exchange for a percentage of future revenue, typically until a certain multiple of the initial investment is repaid. This isn’t traditional debt but has a repayment-like structure without equity dilution.

Making the Right Choice for Your Business

There’s no one-size-fits-all answer to whether debt or equity financing is better. The optimal choice depends on several factors unique to your business:

- Stage of Your Business: Early-stage startups often lean towards equity due to uncertain cash flow, while mature businesses with stable income can leverage debt.

- Growth Potential: High-growth companies needing significant capital to scale quickly might find equity more suitable.

- Risk Tolerance: How comfortable are you with fixed payments (debt risk) versus giving up ownership (equity risk)?

- Control Preference: How important is it for you to maintain absolute control over your company?

- Cost of Capital: Evaluate the true cost of interest payments versus the long-term value of the equity you’re giving away.

- Access to Capital: What type of financing is realistically available to you based on your business’s creditworthiness, industry, and network?

- Need for Expertise: Do you need just money, or do you also need the strategic guidance and connections that come with certain equity investors?

Conclusion: Arm Yourself with Knowledge

Understanding the fundamental differences between Debt Financing and Equity Financing is critical for any entrepreneur. Each path offers distinct advantages and disadvantages that can profoundly impact your business’s financial structure, operational control, and future trajectory.

Debt offers control and predictability but comes with a fixed repayment obligation. Equity provides patient capital and strategic partnerships but requires giving up ownership and sharing control.

By carefully evaluating your business’s current stage, growth aspirations, risk appetite, and specific needs, you can make an informed decision that sets your company on the most sustainable and successful path to growth. Don’t rush the decision; consult with financial advisors, legal experts, and mentors to ensure you choose the funding strategy that truly aligns with your vision.

Post Comment