Consumer Confidence: A Key Indicator of Crisis (and Economic Health)

Have you ever wondered why economists and news anchors constantly talk about "consumer confidence"? It might sound like a fancy term, but at its heart, it’s incredibly simple and yet profoundly powerful. Think of it as the economic "mood ring" of a nation – it tells us how people are feeling about their financial future and the economy as a whole. And when that mood starts to sour, it can often be an early warning sign of a coming crisis.

In this long-form article, we’ll dive deep into what consumer confidence is, why it matters so much, and how it acts as a crucial indicator, especially when the economy is heading for choppy waters. We’ll make sure it’s easy for anyone to understand, even if you’re new to the world of economics!

What Exactly Is Consumer Confidence? (The Economic Mood Ring)

At its most basic, consumer confidence is a measure of how optimistic or pessimistic consumers (that’s you and me!) are about the overall state of the economy and their own personal financial situations. It’s about their willingness to spend money.

Imagine this: If you feel secure in your job, believe prices are fair, and expect things to get better, you’re probably more likely to buy that new car, go on vacation, or invest in home improvements. This feeling of security and optimism is high consumer confidence.

On the flip side, if you’re worried about losing your job, see prices rising rapidly, and feel uncertain about the future, you’re more likely to save money, cut back on non-essential spending, and put off big purchases. This feeling of fear and uncertainty is low consumer confidence.

How Is It Measured? The Surveys!

Consumer confidence isn’t just a hunch; it’s calculated based on actual surveys. The two most well-known are:

- The Conference Board Consumer Confidence Index (CCI): This survey polls 5,000 households across the U.S. every month.

- The University of Michigan Consumer Sentiment Index (CSI): This one surveys 500 households, also monthly.

Both surveys ask similar questions, focusing on two main areas:

- Present Economic Conditions: How do you feel about your current personal finances and the current job market?

- Future Expectations: How do you expect your financial situation and the general economy to be six months from now?

The answers are then crunched into an index number. A higher number indicates greater confidence, and a lower number signals less confidence.

Why Is Consumer Confidence So Important? (The Domino Effect)

You might be thinking, "So what if people are feeling good or bad? How does that affect the entire economy?" The answer is: a lot! Consumer spending is the engine that drives most modern economies.

Here’s why consumer confidence is such a big deal:

- Consumer Spending is King: In many developed countries, consumer spending accounts for a massive portion (often 60-70%) of the entire economy’s activity, measured by Gross Domestic Product (GDP). When consumers feel good, they spend more. When they spend more, businesses sell more.

- Boosts Business Investment and Hiring: When businesses see consumers spending, they become more confident too. They’ll invest in new equipment, expand their operations, and hire more people to meet the increased demand. This creates a positive cycle.

- Impacts Financial Markets: Investor confidence is often linked to consumer confidence. If consumers are spending, company profits are likely to rise, which can boost stock prices. Conversely, falling confidence can signal trouble for corporate earnings, leading to stock market declines.

- Influences Lending and Borrowing: When confidence is high, people are more willing to take out loans for homes, cars, or education, knowing they’ll likely be able to pay them back. This stimulates the banking sector and the economy.

In essence, consumer confidence is a self-fulfilling prophecy to some extent. If enough people believe the economy will do well, their spending habits can help make it do well. And if they believe it will do poorly, their cutbacks can contribute to a slowdown.

Consumer Confidence as a Crisis Indicator (The Early Warning System)

This is where consumer confidence really shines as a crucial economic tool. It’s not just a reflection of the current mood; it’s often a leading indicator, meaning it tends to change before the broader economy does.

When Confidence Falls: A Red Flag for Crisis

A significant and sustained drop in consumer confidence is a serious warning sign that a crisis might be brewing or is already underway. Here’s what it often signals:

- Impending Recession: When consumers stop spending, businesses see their sales drop. This can lead to reduced production, layoffs, and a general economic slowdown – the hallmarks of a recession.

- Fear of Job Losses: A big reason for declining confidence is often a fear of losing jobs or difficulty finding new ones. People become cautious with their money when their primary source of income feels insecure.

- Reduced Major Purchases: People will postpone buying homes, cars, or major appliances. These "big ticket" items are highly sensitive to confidence levels and their decline can severely impact entire industries.

- Increased Savings, Decreased Debt: While saving is good for individuals, if everyone suddenly stops spending and starts saving en masse, it starves the economy of demand. People also become hesitant to take on new debt.

- Negative Feedback Loop: Low confidence leads to less spending, which leads to lower business profits, which can lead to layoffs, which further reduces confidence. This creates a downward spiral that can be hard to break.

Think of it like this: If you see a lot of people suddenly rushing to buy umbrellas, it’s a good sign that rain is coming, even if you don’t feel the first drop yet. Similarly, when consumer confidence plummets, it suggests an economic storm is on the horizon.

When Confidence Rises: A Sign of Recovery

Conversely, a sustained rise in consumer confidence is a strong signal that the economy is recovering or strengthening. It indicates:

- Increased Spending: People are feeling better about their jobs and finances, so they open their wallets.

- Business Growth: Businesses respond to increased demand by expanding and hiring.

- Economic Stability: A steady increase in confidence suggests that the worst is over, and the economy is on a path to sustained growth.

Factors That Influence Consumer Confidence (What Makes Us Feel Good or Bad?)

Consumer confidence isn’t just a random feeling; it’s influenced by a variety of real-world economic and social factors.

- 1. Job Market (Employment & Unemployment):

- Good News: Low unemployment rates, plenty of job openings, and rising wages make people feel secure and optimistic.

- Bad News: High unemployment, widespread layoffs, and stagnant wages breed fear and uncertainty. This is arguably the most impactful factor.

- 2. Inflation (Rising Prices):

- Good News: Stable or slowly rising prices mean your money goes further.

- Bad News: Rapidly rising prices (inflation) for everyday necessities like food, gas, and housing can make people feel poorer, even if their wages are increasing. Their purchasing power is eroding.

- 3. Interest Rates:

- Good News: Low interest rates make it cheaper to borrow money for homes, cars, and business investments.

- Bad News: High interest rates make borrowing expensive, slowing down big purchases and business expansion.

- 4. Stock Market Performance:

- Good News: When the stock market is doing well, people who own stocks (directly or through retirement funds) feel wealthier and more secure. This is called the "wealth effect."

- Bad News: A falling stock market can make people feel poorer and more cautious.

- 5. Housing Market:

- Good News: Rising home values make homeowners feel wealthier and more confident in their biggest asset.

- Bad News: Falling home values can make people feel less secure, especially if they have a mortgage.

- 6. Government Policy & Political Stability:

- Good News: Clear, stable government policies and a sense of political calm can foster confidence.

- Bad News: Political instability, uncertainty about future laws (like taxes or regulations), or major policy shifts can make people hesitant.

- 7. Global Events:

- Good News: Periods of global peace and stable trade relations.

- Bad News: Wars, pandemics, natural disasters, or international trade disputes can create widespread anxiety and impact supply chains, leading to lower confidence.

- 8. Media Coverage:

- The way economic news is reported can also influence public sentiment. Constant negative headlines, even if accurate, can amplify fear and reduce confidence.

Real-World Examples: When Confidence Plunged

Looking back at history, consumer confidence has often foreshadowed or mirrored major economic crises:

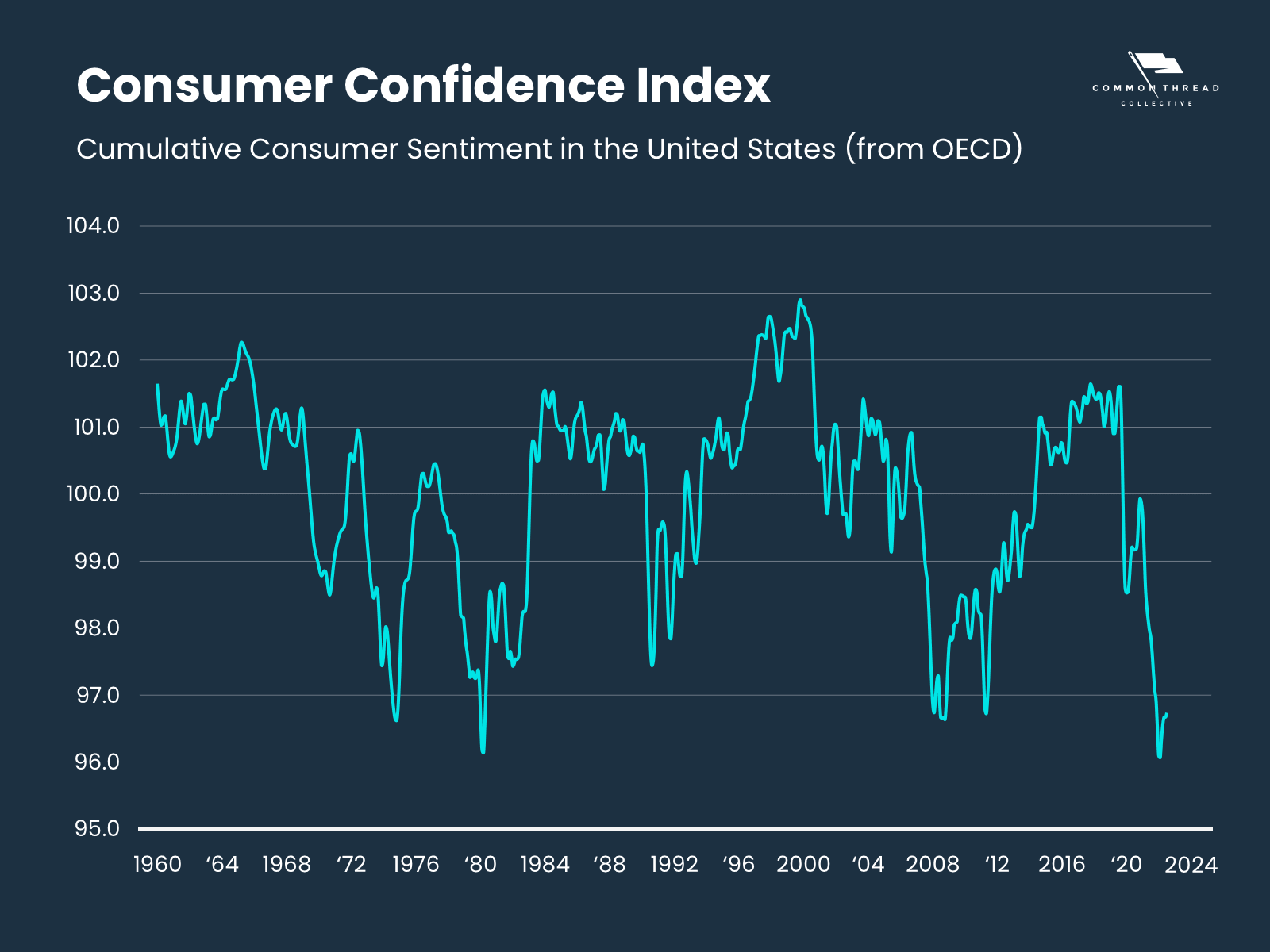

- The 2008 Financial Crisis: Leading up to and during the Great Recession, consumer confidence plummeted as the housing market collapsed, banks failed, and millions lost their jobs. People stopped spending, which deepened the crisis.

- The COVID-19 Pandemic (2020): When the pandemic hit, consumer confidence saw one of its steepest drops in history. Lockdowns, job losses, and extreme uncertainty about health and the future led to a massive cutback in spending, contributing to a sharp but brief recession.

- High Inflation Periods: During times of high inflation, like the late 1970s or more recently in 2021-2022, consumer confidence tends to fall because people feel their money isn’t going as far, even if their wages are rising.

In all these cases, a significant drop in consumer confidence was not just a symptom but also a contributing factor to the economic downturn.

How Businesses and Policymakers Use Consumer Confidence

Because it’s such a vital indicator, both businesses and governments pay close attention to consumer confidence data:

For Businesses:

- Production Planning: If confidence is high, businesses might increase production, order more supplies, and prepare for higher sales. If it’s low, they might scale back.

- Hiring Decisions: Confident consumers mean confident businesses, leading to more job creation.

- Marketing & Sales Strategies: In periods of low confidence, companies might focus on discounts, essential goods, or more cautious advertising. When confidence is high, they might promote luxury items or innovative products.

- Investment Decisions: Businesses are more likely to invest in new factories, research, and development when they anticipate strong consumer demand.

For Policymakers (Governments & Central Banks):

- Monetary Policy (Interest Rates): Central banks (like the Federal Reserve in the U.S.) watch confidence closely. If confidence is falling rapidly, they might consider lowering interest rates to encourage borrowing and spending, hoping to avert a deeper recession.

- Fiscal Policy (Government Spending & Taxes): Governments might introduce stimulus packages (like direct payments or tax cuts) or increase infrastructure spending if consumer confidence is low, aiming to inject money directly into the economy and boost morale.

- Economic Forecasting: Confidence data helps policymakers predict future economic trends and make informed decisions about how to manage the economy.

Limitations and Nuances of Consumer Confidence

While incredibly useful, consumer confidence isn’t a crystal ball and has some limitations:

- It’s Not the Only Indicator: Economists look at dozens of indicators (unemployment rates, GDP growth, inflation, manufacturing data, etc.). Consumer confidence is one piece of a much larger puzzle.

- It Can Be Volatile: Confidence can swing based on breaking news, a major political event, or even a particularly good or bad month for the stock market. One-off dips might not signal a crisis. It’s the sustained trends that matter.

- Actions Speak Louder Than Words: Sometimes, people say they’re confident, but their spending habits don’t always match. Conversely, they might express pessimism but still spend if they have to.

- Different Demographics: Confidence can vary significantly across different age groups, income levels, or geographic regions. A single national number might mask important underlying trends.

Conclusion: Understanding the Economic Pulse

Consumer confidence is far more than just a number; it’s a vital pulse check on the economic health of a nation. It reflects the collective optimism or fear of millions of individuals, and that collective sentiment has a powerful ability to shape economic outcomes.

For beginners in economics, understanding consumer confidence is a fantastic starting point. It helps you grasp how individual feelings translate into massive economic trends, how spending drives growth, and why a sudden drop in that "mood" can be an early, crucial indicator of a looming crisis.

So, the next time you hear about consumer confidence on the news, you’ll know it’s not just a statistic – it’s a window into the collective mindset that often dictates the path of our economy, guiding us through times of growth and warning us of potential storms ahead.

Post Comment