Mastering Your Money: Understanding the Time Value of Money (TVM) for Beginners

Have you ever heard the saying, "A bird in the hand is worth two in the bush"? Or perhaps, "A dollar today is worth more than a dollar tomorrow"? While these might sound like old proverbs, they hold a fundamental truth that underpins all of finance and economics: the Time Value of Money (TVM).

For many, financial concepts can seem daunting, filled with jargon and complex formulas. But understanding TVM is one of the most powerful tools you can add to your financial toolkit. It’s not just for investors or economists; it’s a concept that impacts your daily decisions, from saving for retirement to taking out a loan.

This comprehensive guide will break down the Time Value of Money into easy-to-understand terms, helping you grasp why your money today has more potential than the same amount in the future.

What Exactly is the Time Value of Money (TVM)?

At its core, the Time Value of Money is the idea that a sum of money is worth more now than the same sum will be at a future date due to its potential earning capacity. In simpler terms, money available today is more valuable than the identical sum in the future.

Think of it this way: If I offered you $100 today or $100 a year from now, which would you choose? Most people would pick the $100 today. Why?

- You could spend it now: Instant gratification!

- You could invest it: That $100 could be put into a savings account or investment, earning interest and growing over the year. A year from now, it might be $105 or $110.

- Inflation: Prices tend to rise over time. The $100 you receive today will likely buy more goods and services than $100 received a year from now.

These three reasons – opportunity to earn, immediate consumption, and inflation – are the fundamental drivers behind TVM. Money has earning power, and delaying its receipt means you lose out on that power.

The Core Reasons Why Money Loses Value Over Time

To truly grasp TVM, it’s essential to understand the forces that diminish the purchasing power of money over time:

- Inflation: This is perhaps the most obvious culprit. Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. If a loaf of bread costs $3 today, and inflation is 3% per year, that same loaf might cost $3.09 next year. Your $100 will buy less bread in the future.

- Opportunity Cost: Every financial decision involves a trade-off. If you choose to receive $100 in a year instead of today, you lose the "opportunity" to invest that $100 today and earn a return on it. This lost potential return is the opportunity cost.

- Risk/Uncertainty: The future is uncertain. There’s always a risk that you might not receive the money promised in the future (e.g., the person promising to pay you might go bankrupt). Money today carries no such future payment risk.

The Pillars of TVM: Interest Rates and Compounding

Interest rates are the engine of TVM. They represent the "cost of money" or the "return on money."

- As a Borrower: When you take out a loan, the interest rate is the price you pay for using someone else’s money.

- As a Lender/Investor: When you save or invest money, the interest rate is the return you earn for letting someone else use your money (or for your money working for you).

There are two main types of interest that are crucial for TVM:

1. Simple Interest

Simple interest is calculated only on the principal amount (the original sum of money). It’s straightforward but less common for long-term investments or loans.

- Example: You invest $1,000 at 5% simple interest for 3 years.

- Year 1 Interest: $1,000 * 0.05 = $50

- Year 2 Interest: $1,000 * 0.05 = $50

- Year 3 Interest: $1,000 * 0.05 = $50

- Total Interest: $150

- Total Value: $1,000 (principal) + $150 (interest) = $1,150

2. Compound Interest (The "Eighth Wonder of the World")

Compound interest is where the magic of TVM truly shines. It’s interest calculated on the initial principal and also on the accumulated interest from previous periods. This means your money starts earning interest on its interest, leading to exponential growth.

- Example: You invest $1,000 at 5% compound interest for 3 years.

- Year 1: $1,000 * 0.05 = $50. Your total is now $1,050.

- Year 2: Interest is calculated on $1,050: $1,050 * 0.05 = $52.50. Your total is now $1,050 + $52.50 = $1,102.50.

- Year 3: Interest is calculated on $1,102.50: $1,102.50 * 0.05 = $55.13. Your total is now $1,102.50 + $55.13 = $1,157.63.

Notice the difference: With simple interest, you ended up with $1,150. With compound interest, you have $1,157.63. While the difference seems small over three years, imagine this over 20, 30, or 40 years! This "interest on interest" effect is often called the snowball effect and is why starting to save and invest early is so crucial.

Key Concepts & Simple Formulas in TVM

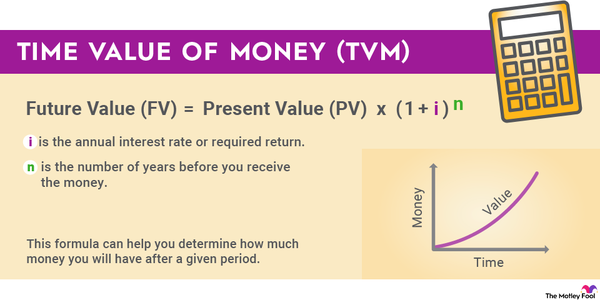

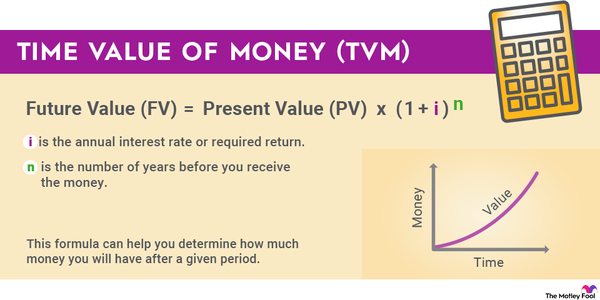

While the actual calculations can get complex, understanding the concepts behind them is vital. TVM primarily involves two core calculations: Future Value (FV) and Present Value (PV).

1. Future Value (FV)

- What it is: Future Value calculates how much an investment made today will be worth at a specific date in the future, assuming a certain interest rate. It answers the question: "If I have $X today, what will it be worth in Y years?"

- Why it’s important:

- Planning for retirement: How much will your current savings grow to?

- Saving for a down payment: How much will you have by a certain date?

- Projecting investment returns: What’s the potential growth of your portfolio?

- Concept: FV = Present Value * (1 + Interest Rate)^Number of Periods

- Simple Example: If you invest $500 today at an annual interest rate of 6%, what will it be worth in 5 years?

- It will be worth more than $500 due to compounding interest.

2. Present Value (PV)

- What it is: Present Value calculates the current worth of a future sum of money or stream of cash flows, discounted at a specific rate. It answers the question: "How much do I need to invest today to have $X in Y years?" or "What is that future payment worth to me today?"

- Why it’s important:

- Evaluating investment opportunities: Is a future payment worth its current asking price?

- Loan analysis: What’s the true cost of a loan based on its future payments?

- Business decisions: Should a company invest in a project based on its projected future profits?

- Concept: PV = Future Value / (1 + Interest Rate)^Number of Periods

- Simple Example: You want to have $10,000 in 10 years for a down payment, and you can earn 7% annually. How much do you need to invest today?

- You’ll need to invest less than $10,000 today because your investment will grow over time.

Compounding vs. Discounting

- Compounding: This is the process of calculating Future Value. You’re taking a present sum and moving it forward in time, growing it with interest. It’s like pushing a snowball down a hill, watching it get bigger.

- Discounting: This is the process of calculating Present Value. You’re taking a future sum and bringing it back to the present, reducing its value by the interest it could have earned (or the inflation it will face). It’s like unwinding the growth of that snowball.

Why TVM Matters: Real-World Applications

Understanding the Time Value of Money isn’t just an academic exercise; it’s a practical skill that empowers you to make smarter financial choices in your everyday life.

-

For Your Investments & Savings:

- Retirement Planning: TVM is the bedrock of retirement planning. Starting to save early, even small amounts, allows the power of compounding to work its magic over decades, leading to a significantly larger nest egg.

- College Savings: Similar to retirement, consistent contributions to a college fund benefit immensely from TVM.

- Investment Decisions: When comparing different investment options, TVM helps you assess which one offers the best return over time, considering the initial outlay and future payouts.

-

For Your Loans & Debt:

- Mortgages & Car Loans: TVM helps you understand how interest accumulates over the life of a loan. A slight difference in interest rate or loan term can mean paying thousands more (or less!) over the years.

- Credit Card Debt: High-interest credit card debt is the enemy of TVM. The high interest rates compound quickly, making it incredibly difficult to pay off unless you tackle it aggressively. Understanding this motivates faster repayment.

-

For Business Decisions:

- Project Evaluation: Businesses use TVM to decide if a new project or investment is worthwhile by comparing the present value of its expected future profits to the cost of the investment.

- Valuation: When buying or selling a business, TVM helps determine its fair market value by discounting future cash flows.

-

For Personal Financial Planning:

- Large Purchases: Should you buy that expensive item now or save up for it? TVM helps you calculate the true cost, including lost potential earnings if you spend your savings today.

- Emergency Funds: Understanding TVM reinforces the importance of having an emergency fund. Money saved today is available immediately, preventing high-interest debt in a crisis.

Practical Tips for Applying TVM in Your Life

Now that you understand the "what" and "why," here are actionable steps to leverage the Time Value of Money for your financial benefit:

- Start Saving and Investing Early: This is the single most important takeaway. The longer your money has to compound, the more significant its growth will be. Even small, consistent contributions can become substantial over time.

- Understand Interest Rates: Pay close attention to interest rates on both your savings/investments and your loans. A higher rate on savings is good; a higher rate on debt is bad.

- Prioritize High-Interest Debt Repayment: If you have credit card debt or other high-interest loans, make paying them off a top priority. The interest on these debts works against you, eroding your future wealth.

- Automate Your Savings: Set up automatic transfers from your checking to your savings or investment accounts. This makes saving consistent and leverages compounding without you having to think about it every month.

- Use Financial Calculators: There are many free online TVM calculators (for FV, PV, etc.). Play around with them to see the impact of different interest rates, time periods, and initial investments. This hands-on experience can be very enlightening.

- Think Long-Term: Resist the urge for immediate gratification when it comes to large sums of money. Consider the long-term implications of your spending and saving decisions.

Conclusion: Your Money’s Potential is in Your Hands

The Time Value of Money isn’t a complex secret reserved for financial wizards. It’s an intuitive and powerful concept that, once understood, can fundamentally change how you view and manage your money.

By recognizing that a dollar today has more earning potential than a dollar tomorrow, you’ll be empowered to:

- Make smarter investment decisions.

- Manage your debt more effectively.

- Plan for a more secure financial future.

Embrace the power of compounding, start saving and investing early, and watch your financial future grow. Your money, given time and the right environment, can truly work wonders for you.

Post Comment