Understanding Asset Allocation for Different Ages: Your Guide to Smart Investing

Investing can feel like navigating a complex maze, especially when terms like "asset allocation" start flying around. But what if we told you it’s actually one of the most fundamental and empowering decisions you’ll make for your financial future? Far from being a one-size-fits-all solution, your investment strategy needs to evolve, just as you do.

This comprehensive guide will demystify asset allocation, explain why your age plays a crucial role, and help you understand how to build a portfolio that aligns with your life stage and financial goals.

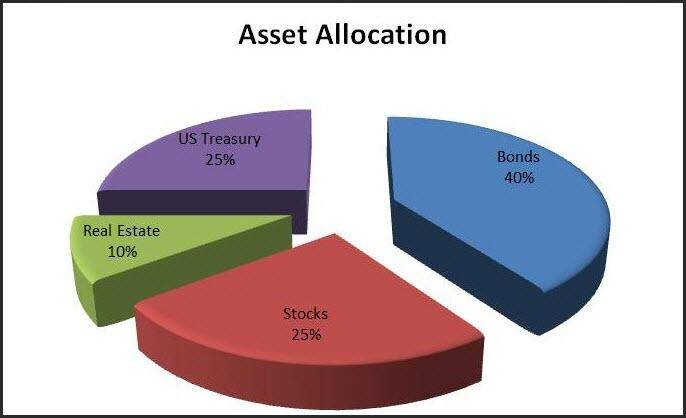

What Exactly is Asset Allocation? The Financial Pie

Imagine your entire investment portfolio as a delicious pie. Asset allocation is simply deciding how big each slice of that pie will be. Each slice represents a different type of investment, known as an "asset class." The most common asset classes are:

- Stocks (Equities): These represent ownership in companies. When you buy a stock, you’re buying a tiny piece of a business.

- Pros: Offer the highest potential for long-term growth and can help your money beat inflation.

- Cons: Can be very volatile (their value goes up and down significantly) in the short term. Higher risk.

- Bonds (Fixed Income): These are essentially loans you make to governments or corporations. In return, they promise to pay you back your original money, plus interest, over a set period.

- Pros: Generally less volatile than stocks, provide a steady stream of income (interest), and can act as a cushion during stock market downturns. Lower risk.

- Cons: Lower potential for growth compared to stocks. Can be affected by interest rate changes.

- Cash & Cash Equivalents: This includes money in savings accounts, money market accounts, or short-term certificates of deposit (CDs).

- Pros: Extremely safe, highly liquid (easy to access).

- Cons: Offers very low returns, often barely keeping pace with inflation, meaning your purchasing power could erode over time.

The core idea of asset allocation is to diversify your investments across these different types to manage risk and maximize potential returns. It’s about finding the right balance that suits your specific situation.

Why Does Your Age Matter in Asset Allocation?

Your age is a powerful indicator of two critical factors that drive your asset allocation decisions:

- Time Horizon: This is the length of time you have before you need to use the money you’re investing.

- Younger Investors: Have a longer time horizon (decades until retirement). This means they have more time to recover from market downturns.

- Older Investors: Have a shorter time horizon. They need their money sooner, so they have less time to recover from losses.

- Risk Tolerance & Capacity:

- Risk Tolerance: Your emotional comfort level with potential losses. Can you sleep at night if your portfolio drops 20%?

- Risk Capacity: Your financial ability to absorb losses without derailing your financial goals. A young person with stable income has a higher risk capacity than someone nearing retirement who relies on their investments.

Generally, the longer your time horizon and the higher your risk capacity, the more aggressive (more stocks) your portfolio can be. As your time horizon shortens and your risk capacity decreases, your portfolio should become more conservative (more bonds and cash).

Asset Allocation Strategies by Age Group

Let’s break down how asset allocation typically shifts as you move through different life stages.

1. The Young Investor (20s-30s): Aggressive Growth & Long-Term Potential

- Characteristics:

- Time Horizon: Very long (30-40+ years until retirement).

- Risk Capacity: High. You have ample time to recover from market volatility.

- Financial Goals: Primarily long-term wealth accumulation and capital growth.

- Typical Asset Allocation:

- Stocks: 80-90%+

- Bonds: 10-20%

- Cash: Minimal (emergency fund only)

- Why this works: At this stage, your biggest asset is time. Stocks, despite their short-term ups and downs, have historically provided the best long-term returns. A market crash in your 20s or 30s can actually be an opportunity to buy more assets at a lower price. You’re building a foundation for significant compounding.

- Example: A 25-year-old might aim for 90% stocks (diversified across US and international) and 10% bonds.

2. The Mid-Career Investor (40s-Early 50s): Balancing Growth & Stability

- Characteristics:

- Time Horizon: Still significant (15-25 years), but retirement is starting to appear on the horizon.

- Risk Capacity: Moderate to high. You’re likely earning more, but you also have more responsibilities (mortgage, kids’ education).

- Financial Goals: Continued growth, but with an increasing eye on preserving some of the wealth you’ve accumulated.

- Typical Asset Allocation:

- Stocks: 60-80%

- Bonds: 20-40%

- Cash: Emergency fund + short-term goals

- Why this works: You still need growth to meet your retirement goals, but you also want to start introducing more stability to protect your growing nest egg. Bonds help smooth out the ride, reducing overall portfolio volatility as you get closer to needing your money.

- Example: A 45-year-old might shift to 70% stocks and 30% bonds.

3. The Pre-Retiree (Late 50s-Early 60s): Protecting Your Nest Egg

- Characteristics:

- Time Horizon: Short (5-10 years until retirement).

- Risk Capacity: Lower. A significant market downturn could severely impact your retirement plans.

- Financial Goals: Capital preservation, generating income, and minimizing risk as you prepare to transition from accumulation to withdrawal.

- Typical Asset Allocation:

- Stocks: 40-60%

- Bonds: 40-60%

- Cash: Increased, for immediate needs and upcoming expenses

- Why this works: The focus shifts from aggressive growth to protecting the wealth you’ve built. Bonds become a larger portion to provide stability and income, reducing the impact of potential stock market declines right before you need to start drawing on your funds. This helps mitigate "sequence of returns risk" – the danger of large losses early in retirement.

- Example: A 58-year-old might adjust to 50% stocks and 50% bonds.

4. The Retiree (60s+): Income & Preservation

- Characteristics:

- Time Horizon: Very short for immediate needs, but still long for overall portfolio longevity (you could live another 20-30 years!).

- Risk Capacity: Low for the portion of your portfolio you’ll need soon, moderate for the long-term portion.

- Financial Goals: Generating reliable income to cover living expenses, capital preservation, and ensuring your money lasts throughout retirement while still maintaining some growth to combat inflation.

- Typical Asset Allocation:

- Stocks: 30-50%

- Bonds: 50-70%

- Cash: Sufficient for 1-3 years of living expenses

- Why this works: Your portfolio needs to provide a steady income stream. Bonds are excellent for this. A smaller allocation to stocks (often dividend-paying or less volatile stocks) helps your portfolio continue to grow slowly and combat inflation over a long retirement, ensuring your money doesn’t run out. The cash buffer is crucial to avoid selling investments during a market downturn.

- Example: A 68-year-old might have 40% stocks, 50% bonds, and 10% cash.

A Simple Rule of Thumb: The Rule of 100/110/120

A common guideline for a quick estimate of your stock allocation is:

- Rule of 100: Subtract your age from 100 to get your suggested stock allocation. (e.g., Age 30: 100 – 30 = 70% stocks)

- Rule of 110: For a slightly more aggressive approach. (e.g., Age 30: 110 – 30 = 80% stocks)

- Rule of 120: For a very aggressive approach (more common for younger investors with high risk tolerance). (e.g., Age 30: 120 – 30 = 90% stocks)

Remember, these are just starting points. Your personal situation will always be the most important factor.

Beyond Age: Other Factors Influencing Your Allocation

While age is a primary driver, it’s not the only one. Your personal circumstances are unique, and these should also guide your asset allocation:

- Your Personal Risk Tolerance: Are you naturally cautious or more comfortable with risk? Even if you’re young, if market volatility causes you extreme stress, you might opt for a slightly more conservative portfolio than suggested.

- Specific Financial Goals: Are you saving for a down payment in 3 years? College tuition in 10? A yacht in 20? Short-term goals often require a more conservative allocation for that specific money, regardless of your age.

- Income Stability: Do you have a stable, secure job, or is your income more volatile? A less stable income might warrant a slightly more conservative approach to your investments.

- Existing Wealth & Debt: If you have significant debt (especially high-interest debt), focusing on paying that down might be a higher priority than aggressive investing. If you have substantial existing wealth, you might have more flexibility.

- Market Conditions: While you shouldn’t drastically change your long-term strategy based on daily news, understanding the broader economic environment (e.g., high inflation, rising interest rates) can inform subtle adjustments or rebalancing decisions.

Key Principles for Smart Asset Allocation

Regardless of your age, these principles will help you manage your portfolio effectively:

- Diversification is Key: Don’t put all your eggs in one basket! Within your stock allocation, invest in different industries, company sizes, and geographies (US and international). Within bonds, consider different types and maturities. Diversification helps reduce risk.

- Rebalancing Regularly: Over time, your asset allocation will drift. If stocks have a great year, their percentage in your portfolio might grow beyond your target. Rebalancing means selling some of your overperforming assets and buying more of your underperforming ones to bring your portfolio back to your target allocation. This is often done annually.

- Review and Adjust: Your life changes, and so should your financial plan. Review your asset allocation at least once a year, or whenever you experience a major life event (marriage, divorce, new child, new job, significant inheritance, retirement).

- Stay the Course (Avoid Emotional Decisions): The market will have ups and downs. Don’t panic and sell everything when the market drops, or get overly greedy and chase hot trends. Stick to your well-thought-out plan.

- Seek Professional Advice: If you find asset allocation overwhelming, or if your financial situation is particularly complex, consider consulting a qualified financial advisor. They can help you assess your risk tolerance, define your goals, and create a personalized plan.

Conclusion: Your Investing Journey is Personal

Understanding asset allocation for different ages isn’t about rigid rules, but about intelligent adaptation. It’s about recognizing that your financial priorities, risk tolerance, and time horizon evolve throughout your life. By thoughtfully adjusting the mix of stocks, bonds, and cash in your portfolio, you can build a robust financial future that supports your goals at every stage.

Start early, stay diversified, rebalance consistently, and remember that your financial journey is a marathon, not a sprint. With a clear understanding of asset allocation, you’re well-equipped to navigate the path to long-term wealth.

Post Comment