What Are Exchange Rates? Your Easy Guide to Fixed vs. Floating Currency Systems

Imagine you’re planning a dream vacation to Europe, or perhaps you’re a small business owner looking to import goods from China. In either scenario, you’ll quickly run into a fundamental concept of global finance: exchange rates.

At its core, an exchange rate tells you how much one currency is worth in terms of another. It’s the price you pay to swap your home currency for a foreign one. But what determines this price? And why do some currencies seem to move around a lot, while others stay remarkably stable?

This comprehensive guide will demystify exchange rates, explaining their importance and diving deep into the two primary systems that govern their movement: fixed exchange rate systems and floating exchange rate systems. Whether you’re a traveler, an investor, or just curious about how the world economy works, understanding exchange rates is a crucial first step.

What Exactly is an Exchange Rate?

Think of an exchange rate like any other price in the market. When you buy a loaf of bread, you pay a certain amount of your local currency. Similarly, when you "buy" a foreign currency, you pay a certain amount of your own currency for it.

In simple terms: An exchange rate is the value of one nation’s currency in relation to another nation’s currency.

For example, if the exchange rate between the US Dollar (USD) and the Euro (EUR) is 1 USD = 0.92 EUR, it means that one US Dollar can buy 0.92 Euros. Conversely, one Euro would buy approximately 1.08 US Dollars (1 / 0.92).

Why do exchange rates matter?

- International Trade: They determine the cost of imports and the competitiveness of exports.

- Travel and Tourism: They dictate how much purchasing power your money has abroad.

- Foreign Investment: They affect the returns on investments made in other countries.

- Global Economics: They reflect a country’s economic health and influence central bank policies.

How are exchange rates typically quoted?

Exchange rates are usually quoted in pairs, like USD/EUR, GBP/JPY, or AUD/NZD. The first currency listed is the base currency, and the second is the quote (or counter) currency. The quote tells you how much of the quote currency you need to get one unit of the base currency.

- Example: If EUR/USD = 1.08, it means 1 Euro (base currency) is worth 1.08 US Dollars (quote currency).

How Exchange Rates Are Generally Determined: Supply and Demand

At a very basic level, exchange rates, like most prices, are influenced by the forces of supply and demand.

- Demand for a Currency: When people want to buy a country’s goods, services, or investments, they need that country’s currency. This increases demand.

- Supply of a Currency: When people want to sell a country’s goods, services, or investments, they offer that country’s currency in exchange for another. This increases supply.

When demand for a currency is high relative to its supply, its value (exchange rate) tends to appreciate (go up). When supply is high relative to demand, its value tends to depreciate (go down).

However, the degree to which supply and demand freely dictate exchange rates depends entirely on the system a country chooses: fixed or floating.

Fixed Exchange Rate Systems: The Anchored Approach

Imagine a boat tied to a dock. It can move a little with the waves, but it largely stays in the same place. That’s similar to a fixed exchange rate system.

A fixed exchange rate system, also known as a pegged exchange rate system, is one where a country’s government or central bank ties the value of its currency to:

- Another major currency (like the US Dollar or Euro).

- A basket of currencies.

- A commodity (historically, gold – known as the Gold Standard).

The goal is to keep the exchange rate stable and predictable, often within a very narrow band.

How Fixed Exchange Rates Work

To maintain the peg, the central bank must actively intervene in the foreign exchange market.

- If the currency starts to depreciate (fall) below its target value: The central bank will sell its foreign currency reserves (e.g., US Dollars) and buy its own domestic currency. This increases demand for the domestic currency, pushing its value back up to the peg.

- If the currency starts to appreciate (rise) above its target value: The central bank will buy foreign currency and sell its own domestic currency. This increases the supply of the domestic currency, pushing its value back down to the peg.

This process requires a country to hold significant reserves of the foreign currency or commodity it’s pegged to.

Advantages of Fixed Exchange Rates

- Stability and Predictability: Businesses involved in international trade and investment face less uncertainty, making long-term planning easier.

- Reduced Inflation: By linking to a stable currency (or commodity), a country can "import" that stability, potentially keeping domestic inflation lower. It also imposes discipline on monetary policy.

- Enhanced Confidence: For developing economies, pegging to a strong, stable currency can build trust among international investors.

- Easier for Trade: Simplifies calculations and reduces exchange rate risk for importers and exporters.

Disadvantages of Fixed Exchange Rates

- Loss of Monetary Policy Independence: The central bank’s primary focus becomes maintaining the peg, limiting its ability to use interest rates or money supply to stimulate the domestic economy or fight unemployment.

- Need for Large Reserves: Countries must maintain substantial foreign currency reserves to intervene in the market, which can be costly and tie up capital.

- Vulnerability to Speculative Attacks: If market participants believe a country cannot sustain its peg (e.g., due to dwindling reserves or a weak economy), they might heavily sell the domestic currency, forcing a painful devaluation (a deliberate lowering of the fixed rate).

- Risk of Misalignment: Over time, the pegged rate might become inconsistent with a country’s economic fundamentals, making its exports too expensive or imports too cheap.

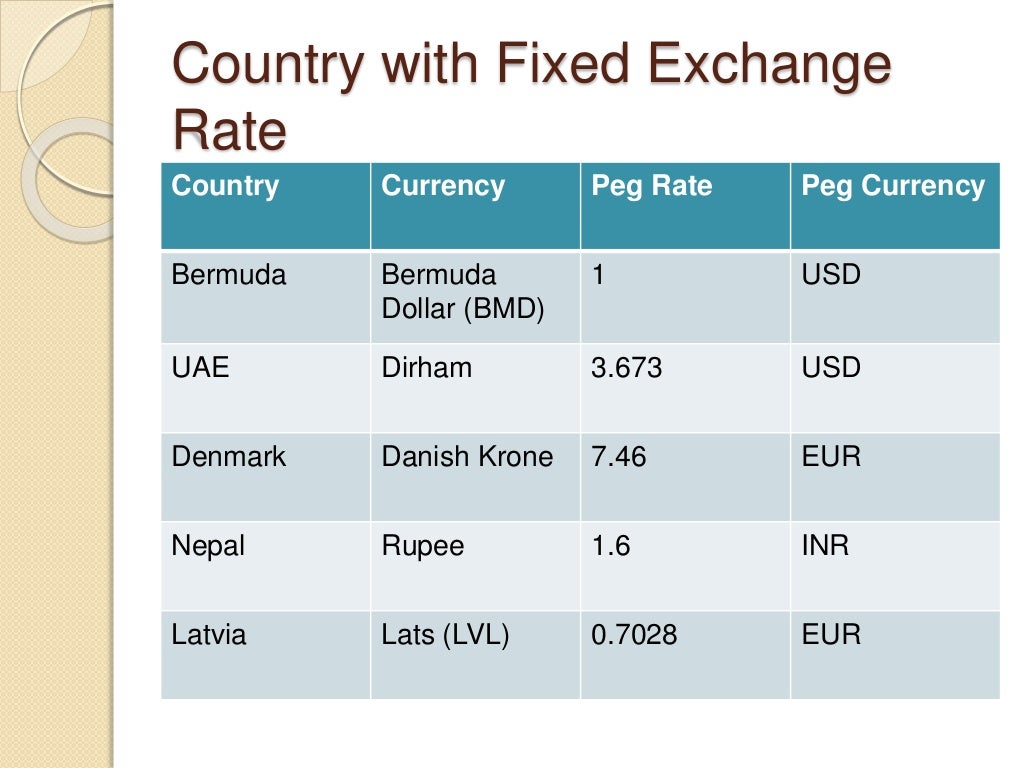

Examples of Fixed Exchange Rate Systems

- Historical: The Gold Standard (many countries pegged their currency to a fixed amount of gold until the early 20th century). The Bretton Woods System (post-WWII until 1971, where major currencies were fixed to the US Dollar, which was fixed to gold).

- Modern:

- Hong Kong Dollar (HKD): Pegged to the US Dollar within a narrow band (7.75-7.85 HKD per USD).

- Saudi Riyal (SAR): Pegged to the US Dollar at 3.75 SAR per USD.

- Many smaller economies and developing nations often peg their currencies to a major trading partner’s currency.

Floating Exchange Rate Systems: The Market-Driven Approach

If a fixed exchange rate system is like a boat tied to a dock, a floating exchange rate system is like a boat freely sailing on the open ocean. Its position is determined by the winds and currents of the market.

A floating exchange rate system is one where the value of a country’s currency is determined by the forces of supply and demand in the foreign exchange market, with minimal or no direct intervention from the government or central bank to maintain a specific rate.

How Floating Exchange Rates Work

In a pure floating system, the central bank allows the exchange rate to move freely based on market forces. If there’s high demand for the currency, its value will rise (appreciate). If there’s high supply, its value will fall (depreciate).

While central banks don’t target a specific rate, they might still intervene occasionally to smooth out excessive volatility or to influence the economy indirectly (e.g., by changing interest rates, which then affects the currency). This is sometimes called a "managed float" or "dirty float."

Factors Influencing Floating Exchange Rates

Numerous factors can shift the supply and demand for a currency in a floating system:

- Interest Rates: Higher interest rates tend to attract foreign investment, increasing demand for the domestic currency.

- Economic Performance: A strong, growing economy tends to attract foreign investment, increasing demand for its currency.

- Inflation Rates: Lower inflation relative to other countries can make a country’s exports more competitive and its currency more attractive.

- Political Stability and Government Policy: Stable political environments and sound economic policies attract investment.

- Trade Balance: A country with a trade surplus (exports > imports) typically sees higher demand for its currency.

- Speculation: Traders buying or selling currencies based on expectations of future price movements can significantly influence rates in the short term.

- Natural Disasters/Crises: Can cause uncertainty and lead to capital outflow, weakening a currency.

Advantages of Floating Exchange Rates

- Monetary Policy Independence: The central bank is free to use interest rates and other tools to manage the domestic economy (e.g., control inflation, stimulate growth, reduce unemployment) without worrying about maintaining a peg.

- Automatic Adjustment to Shocks: If a country faces an economic downturn or external shock, its currency can depreciate, making its exports cheaper and imports more expensive. This can help the economy adjust by boosting exports and reducing imports.

- No Need for Large Reserves: Central banks don’t need to hold vast amounts of foreign currency reserves just to defend a peg.

- Reduced Risk of Speculative Attacks: Because the rate is allowed to move, there’s less incentive for massive speculative selling designed to break a peg.

Disadvantages of Floating Exchange Rates

- Volatility and Uncertainty: Exchange rates can fluctuate significantly and unpredictably, making international trade and investment planning more challenging and risky for businesses.

- Inflationary Pressures: A significant depreciation of the currency can make imports more expensive, leading to "imported inflation."

- Potential for Overshooting: Exchange rates can sometimes move beyond what economic fundamentals would suggest, leading to periods of over- or undervaluation.

- Lack of Discipline: Without the external discipline of a peg, governments might be more inclined to pursue inflationary monetary policies.

Examples of Floating Exchange Rate Systems

Most major developed economies operate under floating exchange rate systems:

- United States Dollar (USD)

- Euro (EUR) (for the Eurozone)

- Japanese Yen (JPY)

- British Pound Sterling (GBP)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

Fixed vs. Floating: A Quick Comparison

| Feature | Fixed Exchange Rate System | Floating Exchange Rate System |

|---|---|---|

| Determination | Government/Central Bank sets a target value | Market forces (supply & demand) primarily determine value |

| Central Bank Role | Actively intervenes to maintain the peg | Generally refrains from direct intervention; may smooth volatility |

| Monetary Policy | Limited independence; focused on maintaining the peg | Full independence; can be used for domestic goals |

| Stability | High (by design) | Variable; can be volatile |

| Reserves Needed | Large foreign currency reserves required | Minimal; not needed for peg defense |

| Vulnerability | Prone to speculative attacks, potential for misalignment | Less prone to speculative attacks (on the rate itself) |

| Examples | Hong Kong Dollar, Saudi Riyal, historical Gold Standard | US Dollar, Euro, Japanese Yen, British Pound |

Which System is Better?

There’s no single "best" exchange rate system. The optimal choice for a country depends on its unique economic characteristics, policy goals, level of development, and integration into the global economy.

- Developing economies might prefer a fixed system to gain credibility, reduce inflation, and attract foreign investment, especially if their financial markets are not yet robust.

- Large, diversified economies with deep financial markets often prefer floating systems to maintain monetary policy independence and allow for automatic adjustment to economic shocks.

Many countries operate a "managed float," where the central bank allows the currency to float but retains the option to intervene if fluctuations become too extreme or disruptive. This attempts to combine the benefits of both systems while mitigating some of their drawbacks.

The Impact of Exchange Rates on Your Everyday Life

Even if you don’t trade currencies, exchange rates quietly influence many aspects of your daily life:

- For Travelers:

- Strong Domestic Currency: Your money buys more abroad, making international travel cheaper.

- Weak Domestic Currency: Your money buys less abroad, making international travel more expensive.

- For Consumers (Shopping):

- Strong Domestic Currency: Imported goods (electronics, cars, coffee, oil) become cheaper.

- Weak Domestic Currency: Imported goods become more expensive, potentially leading to higher prices for consumers.

- For Businesses:

- Strong Domestic Currency: Makes exports more expensive for foreign buyers (hurts exporters); makes imports cheaper for domestic businesses (benefits importers).

- Weak Domestic Currency: Makes exports cheaper for foreign buyers (benefits exporters); makes imports more expensive for domestic businesses (hurts importers).

- For Investors:

- If you invest in foreign stocks or bonds, changes in the exchange rate can impact your returns when you convert them back to your home currency. A strong domestic currency can erode foreign investment gains.

Conclusion: Exchange Rates – The Pulse of Global Connection

Exchange rates are far more than just numbers on a screen; they are the fundamental link connecting economies worldwide. They reflect a nation’s economic health, influence trade flows, dictate travel costs, and shape investment decisions.

Whether a country chooses a fixed or floating exchange rate system profoundly impacts its economic policy and its vulnerability to global shocks. While fixed systems offer stability and predictability, they come at the cost of monetary policy independence. Floating systems, conversely, provide flexibility and automatic adjustment but introduce volatility.

Understanding these dynamics empowers you to better grasp global news, make informed financial decisions, and appreciate the intricate dance of international commerce that plays out every single day.

Post Comment