The Role of Fiscal Policy in Controlling Inflation: A Beginner’s Guide

Ever wonder why prices for your favorite goods and services seem to keep going up? That widespread increase in prices is what we call inflation. While a little inflation can be a sign of a healthy, growing economy, too much of it can erode your purchasing power, making your hard-earned money buy less. It’s like your wallet suddenly got a hole in it!

So, what can be done about it? Governments have powerful tools at their disposal, and one of the most significant is fiscal policy. This article will break down, in simple terms, how the government’s decisions about spending and taxation play a crucial role in controlling inflation.

Understanding Inflation: Why Do Prices Go Up?

Before we dive into fiscal policy, let’s quickly grasp the basics of inflation.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. Think of it this way: if a loaf of bread cost $2 last year and now costs $2.20, that’s inflation in action.

Why is it Bad?

- Erodes Purchasing Power: Your money buys less over time.

- Uncertainty: Businesses find it hard to plan, and consumers don’t know what prices to expect.

- Reduces Savings Value: Money saved today will be worth less in the future.

- Wage Lag: Wages often don’t keep pace with rising prices, leading to a decline in real income.

Main Causes of Inflation (Simplified):

- Demand-Pull Inflation: This happens when there’s too much money chasing too few goods. Everyone wants to buy, buy, buy, but there isn’t enough stuff to go around, so sellers can raise prices. It’s like a bidding war for limited items.

- Cost-Push Inflation: This occurs when the cost of producing goods and services increases (e.g., higher raw material prices, increased wages). Businesses then pass these higher costs onto consumers through higher prices.

Fiscal policy primarily targets demand-pull inflation by influencing the overall demand in the economy.

What is Fiscal Policy?

Fiscal policy refers to the government’s use of spending and taxation to influence the economy. It’s essentially the government’s budget decisions.

Imagine your household budget: you decide how much money to spend (on groceries, rent, entertainment) and how much to earn (from your job). The government does the same, but on a much larger scale, affecting millions of people and businesses.

The Two Main Levers of Fiscal Policy:

-

Government Spending: This includes all the money the government spends on things like:

- Infrastructure projects (roads, bridges, schools)

- Defense and military

- Healthcare programs

- Education

- Salaries for government employees

- Transfer Payments: Money given directly to individuals without a direct exchange of goods or services (e.g., unemployment benefits, social security, welfare).

-

Taxation: This refers to the money the government collects from individuals and businesses in the form of taxes, such as:

- Income tax

- Sales tax

- Corporate tax

- Property tax

Budget Outcomes:

- Budget Deficit: When government spending is greater than tax revenue.

- Budget Surplus: When tax revenue is greater than government spending.

- Balanced Budget: When spending equals revenue.

The Link: How Fiscal Policy Fights Inflation

When inflation is high, it often means there’s too much demand in the economy. People and businesses are spending a lot, creating that "too much money chasing too few goods" scenario. To cool down this overheated economy and bring prices back under control, the government employs contractionary fiscal policy.

Contractionary Fiscal Policy:

The goal of contractionary fiscal policy is to reduce the overall demand (aggregate demand) in the economy. By doing so, it eases the pressure on prices and helps to stabilize them.

Here’s how the government uses its fiscal levers to combat inflation:

1. Decreasing Government Spending

- How it Works: When the government spends less, it directly reduces the amount of money flowing into the economy. Fewer government projects mean less demand for labor and materials. Lower spending on goods and services by the government means fewer sales for businesses.

- Impact on Inflation: This reduction in overall demand helps to lower prices. If the government stops building as many roads, there’s less demand for concrete and labor, which can slow down price increases in those sectors and ripple through the economy.

- Examples:

- Delaying new infrastructure projects.

- Cutting back on certain government programs.

- Reducing the size of the government workforce.

2. Increasing Taxes

- How it Works: When taxes are increased (e.g., income tax, sales tax), individuals and businesses have less disposable income.

- For Individuals: Higher income tax means less money left over for spending and saving. Higher sales tax makes goods more expensive, discouraging purchases.

- For Businesses: Higher corporate taxes can reduce their profits, potentially leading them to invest less or raise prices less aggressively.

- Impact on Inflation: With less money to spend, consumers naturally reduce their purchases. This decrease in consumer demand helps to alleviate the upward pressure on prices.

- Examples:

- Raising income tax rates for individuals.

- Increasing the corporate tax rate.

- Introducing new sales taxes or increasing existing ones.

3. Reducing Transfer Payments

- How it Works: Transfer payments are funds given by the government to individuals, such as unemployment benefits or welfare. Reducing these payments means recipients have less income, leading to reduced spending.

- Impact on Inflation: Similar to increasing taxes, reducing transfer payments directly lowers the disposable income of a segment of the population, thereby contributing to a decrease in overall demand.

- Examples:

- Tightening eligibility for certain welfare programs.

- Reducing the duration or amount of unemployment benefits.

In essence, when faced with high inflation, the government uses fiscal policy to "tighten the purse strings" – both its own and, indirectly, the public’s – to cool down an overheated economy.

Why Use Fiscal Policy for Inflation Control?

- Direct Impact on Demand: Fiscal policy directly influences the total demand for goods and services in the economy.

- Targeted Impact (Potentially): While often broad, specific spending cuts or tax changes can sometimes be aimed at particular sectors contributing to inflation.

- Political Visibility: Fiscal policy changes are often debated publicly, making the government’s actions transparent (though not always popular).

Challenges and Limitations of Fiscal Policy

While powerful, fiscal policy isn’t a magic bullet and comes with its own set of challenges:

- Political Will: Implementing contractionary fiscal policy (cutting spending, raising taxes) is often unpopular with voters and can be difficult for politicians to enact, especially close to elections. No one likes paying more taxes or seeing services cut.

- Time Lags:

- Recognition Lag: It takes time to recognize that inflation is a persistent problem.

- Decision Lag: It takes time for politicians to agree on and pass new laws related to spending and taxation.

- Implementation Lag: Once enacted, it takes time for the policy changes to actually take effect in the economy.

- Impact Lag: Even after implementation, it takes time for the full effects of the policy to be felt on inflation. These lags can mean the policy hits the economy too late, potentially even causing a recession if the inflationary pressures have already subsided.

- Accuracy of Data and Forecasting: Governments rely on economic data and forecasts, which are not always perfectly accurate. Overestimating or underestimating inflationary pressures can lead to policies that are too strong or too weak.

- Crowding Out (Potential Side Effect): If the government tries to reduce spending to fight inflation but continues to borrow heavily (e.g., to finance existing debts), this can sometimes lead to "crowding out," where government borrowing drives up interest rates, making it harder for private businesses to borrow and invest.

- Supply-Side Inflation: Fiscal policy is less effective against inflation caused by supply shocks (e.g., a sudden increase in oil prices due to geopolitical events). These require different solutions, perhaps focusing on increasing supply or reducing reliance on certain resources.

Fiscal Policy vs. Monetary Policy: A Quick Look

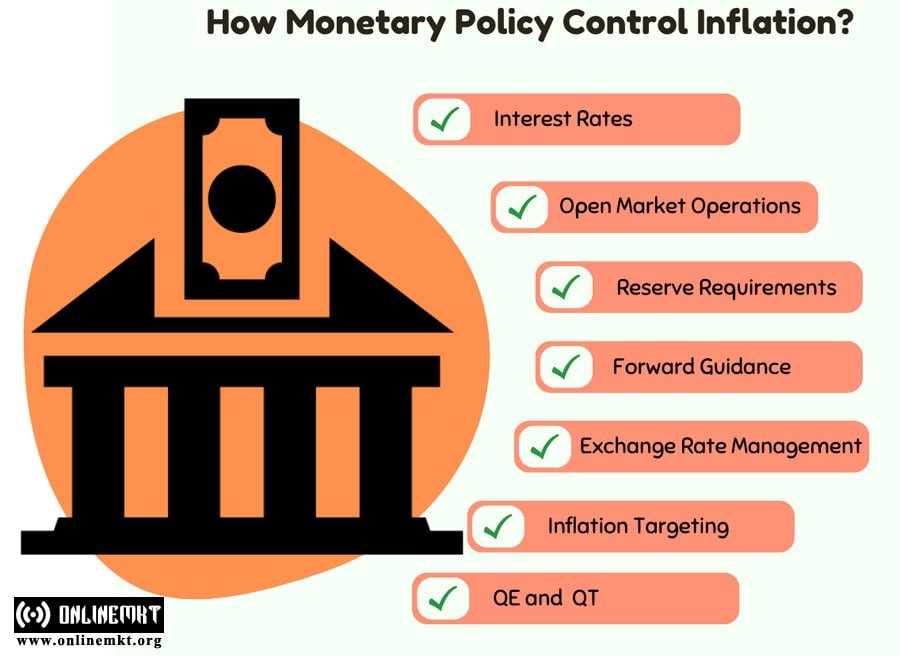

It’s important to remember that fiscal policy isn’t the only tool governments use. Monetary policy, controlled by the central bank (like the Federal Reserve in the U.S. or the European Central Bank), also plays a critical role in managing inflation.

- Monetary Policy Tools: Primarily involves adjusting interest rates and controlling the money supply.

- How it Fights Inflation: By raising interest rates, the central bank makes borrowing more expensive, discouraging spending and investment, thereby cooling down demand.

- Collaboration: Often, fiscal and monetary policies work hand-in-hand. For instance, a government might cut spending while the central bank raises interest rates, creating a stronger, more coordinated effort to combat inflation.

Conclusion

Fiscal policy, through the strategic manipulation of government spending and taxation, is a vital tool in the government’s arsenal against inflation. By reducing overall demand in an overheated economy, it helps to stabilize prices and preserve the purchasing power of money.

However, its implementation requires careful consideration of political realities, potential time lags, and the broader economic context. When used wisely and in conjunction with other economic policies, fiscal policy can be highly effective in maintaining price stability, which is crucial for a healthy and predictable economic environment for everyone. Understanding how it works empowers you to better grasp the economic decisions that shape our world.

Post Comment